Examining the Upcoming Semiconductor Tariffs: An In-Depth Analysis

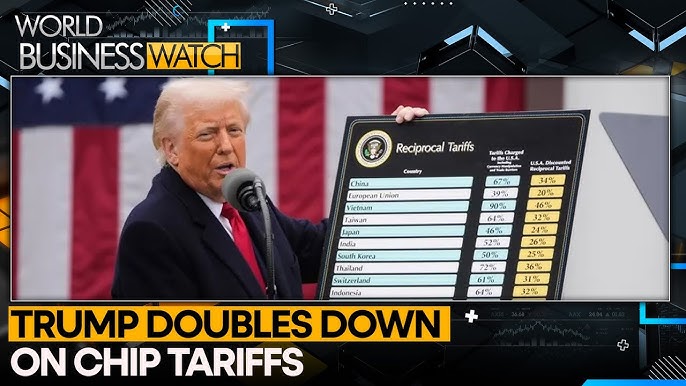

In recent days, the political and business communities have been buzzing about President Donald Trump’s latest announcement regarding semiconductor tariffs. As the nation’s industrial communities—ranging from automotive to industrial manufacturing—feel the tremors of these policy shifts, it is essential to take a closer look at what the new tariffs entail and how they may reshape not only international trade but also domestic manufacturing incentives.

Throughout this editorial, we will dig into the proposed changes, shedding light on the tricky parts of trade policies, the hidden complexities of domestic supply chains, and the subtle details that impact industries far and wide. Whether you are an industry veteran or a curious observer, understanding these policies and their potential repercussions is key to finding your way in today’s evolving economic landscape.

Understanding the Basis of the Tariff Policy

Trump’s recent statements indicate that semiconductor manufacturers could face a tariff structure that begins with a lower rate, escalating sharply if domestic production does not ramp up accordingly. This staggered approach aims to encourage companies to shift their operations back to the United States. The president’s proposal is part of a broader Section 232 investigation, a process deployed to assess how semiconductor imports might threaten national security and domestic supply chains.

At its core, the policy is designed to provide an incentive for semiconductor manufacturers to set up shop on U.S. soil. By instituting tariffs that grow over time, foreign companies are given an initial period to reconsider their manufacturing locations. If they fail to build domestic operations, they would be penalized with high tariffs that could significantly drive up the cost of imported chips.

The Rationale Behind the Tariff Structure

The new policy embodies a strategic shift in U.S. trade policy. The administration is attempting to steer companies away from over-reliance on foreign production and to rejuvenate domestic manufacturing. This approach is intended to create jobs, stimulate local economies, and secure the supply chain for critical components. However, as with many sweeping changes, the implementation has its own set of tricky parts and tangled issues which industry analysts are busy trying to sort out.

First, the graduated tariff system is seen by some as a pragmatic step—a softer launch designed to allow companies a transitional period before facing punitive measures. Yet, others view it as an ambiguous commitment, as the exact percentages and timelines remain vague. This ambiguity has led to concerns in the industry: while the promise of domestic incentives is encouraging, the unclear details might add layers of confusion for businesses trying to plan long-term investments.

Assessing the Impact on Domestic Manufacturing

The idea behind promoting domestic production is not new. Over the past few years, policymakers have consistently highlighted the need for reducing the country’s dependency on overseas suppliers for critical technologies. The semiconductor sector, essential for everything from electric vehicles to advanced robotics, is at the heart of this debate.

The potential benefits of shifting production domestically include job creation, increased investment in advanced manufacturing facilities, and enhanced technological sovereignty. However, the process is not without its nerve-racking challenges. Companies accustomed to the efficiencies of global supply chains now face the task of reconfiguring their operations within a new economic context.

Many business leaders warn that the transition could be laden with problems if not handled with care. The domestic infrastructure may need significant upgrades to support high-tech manufacturing. There are also potential trade-offs in terms of cost and efficiency. While tariffs might encourage companies to produce locally, they could also increase production costs in the short run, at a time when global competition is fiercer than ever.

Economic Implications of a Shift in Semiconductor Supply

Tariffs as a tool of economic policy have always been a double-edged sword. On one hand, they can protect domestic industries from being overwhelmed by cheaper imports. On the other, they can lead to higher prices for consumers and businesses alike when the costs of production are passed down through the supply chain.

In the case of semiconductors, the stakes are particularly high. These chips are the lifeblood of modern electronics, powering everything from smartphones and computers to cars and industrial equipment. A disruption in the supply chain due to increased tariff costs could have far-reaching consequences for multiple sectors. Therefore, while many applaud the move as critical for long-term national interests, short-term disruptions and increased project costs should not be underestimated.

The economic implications also extend internationally. Countries that have built entire industries around the production and export of semiconductors may find themselves in a challenging position if the U.S. moves decisively towards domestic-focused policies. This could trigger retaliatory measures, creating a ripple effect throughout the international trade community.

Detailed Examination of the Section 232 Investigation

Section 232 of the Trade Expansion Act of 1962 has been the basis for several tariff impositions in the past, including those on steel, aluminum, and copper. Its current application to the semiconductor industry marks a significant extension of the policy’s reach. The investigation seeks to understand if the massive influx of semiconductor imports could undermine national security by destabilizing the domestic supply chain—a concern that resonates deeply with both policymakers and business leaders.

Critics of Section 232 argue that such measures can be overly broad, impacting not only companies but also the overall industry dynamics in unpredictable ways. The investigation’s findings, and the subsequent policies, could have sweeping consequences for the semiconductor industry, resonating through the automotive, electronics, and manufacturing sectors.

The key here is the balance between promoting national interests and ensuring that policy changes do not inadvertently stifle innovation or impose overwhelming costs on domestic businesses. Those in favor of the policy emphasize that protecting technological infrastructure is super important, while opponents worry about the unintended consequences that could arise as a result of distancing from global trade practices.

Domestic Versus Global Competition: Finding a Path Forward

One of the toughest challenges in formulating and implementing these tariffs is striking the right balance between bolstering domestic industry and maintaining a healthy flow of international trade. Modern manufacturing relies heavily on international cooperation for raw materials, advanced components, and innovative technologies. Cutting these ties too drastically could have unintended consequences.

It is important to acknowledge that trade policies rarely operate in isolation. The semiconductor tariffs represent one piece of a broader economic puzzle, where trade relations, domestic policy, and global market dynamics intersect. The current proposal is an attempt to find a path that encourages domestic investment without completely isolating the nation from the benefits of global cooperation.

Some industry stakeholders suggest that instead of viewing tariffs as the sole solution, a multi-pronged strategy could yield better results. This strategy may include:

- Tax Incentives for Domestic Production: Offering refunds or credits to companies that commit to building or expanding facilities domestically.

- Investment in Research and Development (R&D): Increasing funding for R&D to ensure that American semiconductor manufacturers can compete technologically with global giants.

- Enhanced Trade Collaborations: Creating bilateral agreements that offer protected access to critical markets while maintaining quality control and standards.

This diversified approach might help mitigate some of the nerve-racking elements associated with abrupt policy changes while still promoting the goal of a more robust domestic industry.

The Ripple Effects on the Automotive Sector

While the semiconductor industry is at the center of this policy debate, the automotive sector is one of its most significant potential casualties. Modern vehicles, particularly those in the electric and autonomous driving spheres, depend heavily on advanced microchips. A sudden escalation in semiconductor prices could lead to higher overall production costs for cars, which, in turn, could affect consumer prices and market dynamics.

Automakers are already grappling with various challenges, from supply shortages to erratic demand fluctuations. Introducing additional cost pressures in the form of tariffs places another complicated piece in an already intricate puzzle. For this reason, many industry experts are keeping a close eye on the developments and urging policymakers to consider these broader implications.

In the face of global competition, automakers increasingly rely on lean manufacturing and optimized supply chains. The ripple effects of rising semiconductor costs might foster accelerated innovation in alternative areas. However, there remains a substantial risk of supply bottlenecks that could slow down production, hinder technological advancements, and force companies to reevaluate their investment strategies.

Trade Policy: The Broader International Perspective

The announcement of semiconductor tariffs is not an isolated move but part of a larger, ongoing evolution in international trade policies. Trade tensions between the U.S. and other leading economies have been on the rise, and the semiconductor tariff could exacerbate these issues. Foreign countries might view such measures as protectionist and retaliate with counter-tariffs or other trade barriers, complicating global supply chains even further.

International trade is a mix of delicate balancing acts. On one side, there is the need to protect local industries from unfair competition; on the other, there is the risk of igniting tit-for-tat measures that can lead to broader economic conflicts. The decision to impose these tariffs places the U.S. at a critical juncture—one that requires careful thought about both immediate benefits and long-term consequences.

For global manufacturers, this development introduces new twists and turns in the already challenging process of steering through international trade regulations. Aligning global supply chains to be resilient in the face of new tariffs involves rethinking logistics, adjusting pricing strategies, and sometimes relocating entire segments of production. Each of these moves has its own set of tricky parts and may entail significant upfront costs before a longer period of benefits might be realized.

Challenges in Implementing Tariff-Based Incentives

Introducing tiered tariffs as an incentive for domestic production is a concept that has its fair share of supporters and detractors. On one hand, it is envisioned as a gentle prod that nudges foreign companies to consider the U.S. for production. On the other, it risks creating an environment where companies find themselves in a state of uncertainty, continually calculating the fine points of cost and benefit.

Key challenges include:

- Determining the Optimal Tariff Rate: Setting a rate that is low enough initially to encourage investment, yet high enough later to meaningfully penalize continued reliance on imports, is a tangled issue.

- Timing and Transparency: Business leaders insist that knowing the timeline and having clear, predictable guidelines are essential for planning their investments. Any ambiguity could make the process feel overwhelming.

- Global Reaction: As previously mentioned, international retaliation could present additional layers of complexity. The balance between incentivizing domestic growth while not alienating key trade partners is a fine line to tread.

These challenges underscore the importance of transparent, well-communicated policies. Businesses need to figure a path through these policies without being overwhelmed by the sudden shifts in economic signals. For policymakers, the task is as much about strategic communication as it is about economic measures.

Comparative Analysis: Past Versus Present Trade Measures

An important context for understanding the current semiconductor tariffs is to look back at similar moves in the past. The U.S. government has historically applied tariffs on sectors such as steel, aluminum, and copper. In many instances, these policies have brought mixed results. While they have sometimes provided a boost to domestic production and a safeguard against dumping practices, they have also occasionally led to increased costs for downstream industries and strained international relations.

Key lessons from past initiatives include:

- Short-Term Disruptions: Previous tariff implementations often resulted in short-term supply shocks that took months, if not years, to resolve.

- Global Market Reactions: Foreign markets sometimes retaliated, impacting export revenues and creating a tug-of-war dynamic that hurt multiple sectors.

- Cost Pass-Through Effects: Higher production costs in raw materials or imported components often transferred along the supply chain, ultimately leading to higher prices for consumers.

- Innovation vs. Protection: While protectionist policies can provide breathing room for domestic firms, they might inadvertently slow down innovation by reducing competitive pressure.

This comparative analysis is essential for understanding that while tariff-based policies have the potential for long-term benefits, they must be calibrated carefully to avoid causing their own set of tangled issues.

Perspectives from Industry Leaders

Industry leaders across the semiconductor, automotive, and broader manufacturing sectors have weighed in on the proposed tariffs with a mixture of cautious optimism and pragmatic concern. Many acknowledge that enhancing domestic production capabilities is essential, but not without the risk of initially raising operating costs.

Some common themes expressed by executives include:

- The Call for Balanced Policies: Leaders stress that any tariff initiative should be part of a broader strategy that includes R&D subsidies, workforce training, and infrastructural investments.

- Uncertainty in the Short Term: The current proposal leaves several little twists unresolved, such as the precise tariff rates and timelines. This uncertainty requires companies to revisit and possibly adjust their long-term investment strategies.

- Global Supply Chain Dependencies: Even though encouraging domestic production is super important, businesses must recognize that modern electronics manufacturing remains deeply intertwined with international supply chains. Any attempt to rapidly decouple from these networks could create unexpected bottlenecks.

While these views vary, they converge on one point: more detailed, predictable policy direction is needed to allow companies to steer through this period of transition effectively. Both support and criticism are rooted in the understanding that the policy’s success depends largely on clear communication and balanced execution.

Exploring the Potential Benefits for the U.S. Economy

If executed successfully, the proposed semiconductor tariffs could yield several key economic advantages for the United States. First and foremost, by incentivizing domestic manufacturing, the policy could bolster job creation in high-tech sectors—a critical outcome for economic health in many regions, especially those that have historically relied on manufacturing jobs.

In addition to job creation, a reinvigorated domestic semiconductor industry could position the U.S. as a central player in global technological innovation. This reorientation might promote long-term benefits such as:

- Enhanced National Security: By reducing dependency on foreign semiconductor supply chains, the country can mitigate risks associated with supply disruptions or political conflicts.

- Stimulated Technological Innovation: Domestic production incentivizes investments in advanced technologies, which may lead to breakthroughs in semiconductor fabrication, automation, and smart manufacturing techniques.

- Economic Diversification: Strengthening one critical sector can have a multiplier effect, promoting growth in related areas like robotics, electric vehicles, and advanced machinery.

Nonetheless, these potential benefits must be weighed against the short-term challenges. The adjustment phase could be overwhelming for many companies, especially those that have long relied on the efficiencies of global production networks. The key is to find a strategy that smooths the transition from international to domestic production, ensuring that short-term disruptions do not overshadow long-term gains.

Risks and Trade-Offs in a Globalized World

In an interconnected global economy, isolationist measures like aggressive tariffs can be as risky as they are promising. While the goal is to boost domestic production, there is a risk that such measures could backfire if they trigger retaliatory actions from key trading partners. The semiconductor industry is emblematic of a market that thrives on a delicate balance of global collaboration and competitive innovation.

Some of the principal risks include:

- Supply Disruptions: As tariffs raise the cost of semiconductor imports, even companies that manufacture domestically might face supply disruptions if they rely on components produced abroad.

- Price Inflation: Increased costs could eventually pass on to consumers or other sectors, potentially causing a rise in the prices of consumer electronics, automobiles, and industrial equipment.

- Retaliation: Trade partners affected by these tariffs could impose counter-tariffs, creating a tit-for-tat escalation that might destabilize broader economic relationships.

The trade-off, therefore, involves balancing the protective benefits of tariffs against the potential for international tension and domestic cost increases. Companies, policymakers, and industry leaders alike must figure a path that preserves the benefits of globalization while still protecting critical national interests.

Long-Term Outlook: A Strategic Pivot to Domestic Strength

Looking forward, the proposed semiconductor tariffs could signal a broader strategic pivot in U.S. trade and industrial policy. This pivot is focused on higher degrees of domestic control over critical technologies. The approach is not merely about penalizing imports but fostering a robust ecosystem where American innovation and manufacturing can flourish.

Key elements of a successful long-term strategy might include:

- Investing in Human Capital: In addition to physical manufacturing capabilities, developing a skilled workforce that can manage highly technical production processes is super important.

- Building State-of-the-Art Facilities: Government incentives could help companies transition from outdated facilities to cutting-edge semiconductor manufacturing plants that are better equipped to face international competition.

- Fostering Public-Private Collaboration: Partnerships between government bodies and private corporations can drive innovation, share risks, and pool resources for major projects with long-term benefits.

By aligning policy measures with the needs of modern industry, the United States could create a more resilient economic foundation. This means not only protecting against immediate global price shocks but also ensuring that domestic manufacturers are equipped to compete in the rapidly evolving tech landscape.

Industry Opportunities in the Face of Tariff Changes

The evolving tariff landscape presents both challenges and opportunities for businesses across the board. Companies willing to invest in long-term domestic production may find themselves at a competitive advantage once the transition period passes. For instance, the automotive sector, which increasingly relies on advanced semiconductor components, might see new opportunities in forging partnerships with domestic chip manufacturers.

Opportunities include:

- Innovative Joint Ventures: Collaborations between semiconductor producers and automotive manufacturers could lead to the creation of custom chips designed specifically for electric and autonomous vehicles.

- Strengthened Supply Chains: Domestic production shifts will likely lead to more reliable local supply chains, reducing the risk of delays and shortages that have plagued the industry in recent years.

- Enhanced Market Positioning: Companies that adapt swiftly to the new environment may market themselves as leaders in American manufacturing, appealing to patriotic consumer sentiments and government contracts alike.

While these opportunities are promising, they come with their own set of confusing bits and intimidating challenges. Businesses will need to invest heavily in capacity building, employee training, and innovation management to fully capitalize on the potential benefits of a more domestically centered production model.

Comparative Perspectives: Learning from Global Best Practices

Many analysts suggest that while the U.S. moves towards expanding domestic production, it might benefit from examining best practices from other major economies that have successfully balanced domestic growth with international cooperation. European nations, for example, have long maintained policies that support strategic industries while also embracing integration into global markets.

These examples demonstrate that:

- Gradual Implementation: Phased approaches to tariff implementations can ease market adjustments and reduce the shock to domestic industries.

- Supportive Ecosystems: Investment in R&D, infrastructure, and workforce training—as seen in many European success stories—can complement protective trade measures.

- Cooperative Global Frameworks: Establishing frameworks that encourage domestic production while maintaining solid ties with international partners can reduce the risk of trade wars.

By studying these models, U.S. policymakers might uncover valuable lessons that can help steer through the tangled issues associated with rapid shifts in trade policy, ensuring that domestic advantages are not achieved at the expense of long-term economic stability.

Implications for Other Key Industries: Beyond Semiconductors

The reverberations of this tariff policy will not be confined solely to semiconductors. Numerous sectors, notably automotive manufacturing and industrial production, are inherently interconnected with the semiconductor supply chain. Any shift in semiconductor pricing or availability has the potential to ripple through these industries, affecting production timelines, innovation trajectories, and overall market competitiveness.

For the automotive industry, which increasingly relies on high-tech components for electric vehicles and autonomous driving capabilities, a steep rise in chip costs could slow down innovation and drive up production expenses. Similarly, sectors like industrial machinery and consumer electronics could face the adverse side effects of increased production costs.

Thus, understanding and planning for these cross-industry impacts is critical. Companies may need to:

- Review Their Supply Chains: Analyzing and, if necessary, restructuring supplier agreements to account for new cost structures.

- Enhance Operational Flexibility: Preparing contingency plans that can help mitigate the effects of supply disruptions or price volatility.

- Invest in Long-Term Collaboration: Working more closely with government bodies and industry consortia to ensure that policy changes do not inadvertently hamper industry growth.

These steps will be essential in managing the interplay between rising domestic production costs and maintaining competitive, globally integrated supply chains.

Policy Recommendations for a Harmonious Transition

Given the myriad of challenging and overwhelming issues associated with this policy shift, the following recommendations may help smooth the transition:

- Clear Communication and Timelines: Officials should ensure that detailed, transparent guidelines are available. This will help business leaders plan investments and steer through changes without feeling overwhelmed by sudden shifts.

- Incremental Tariff Adjustments: Instead of abrupt spikes in tariffs, a gradual, phased approach allows companies to adjust operations, accommodating the necessary twists and turns in cost management.

- Supporting Infrastructure Investment: Federal and state governments should consider providing incentives for upgrading manufacturing infrastructure, directly addressing the hidden complexities associated with transitioning from global to domestic supply models.

- Fostering Innovation through Public-Private Partnerships: Collaborative research and development initiatives can ensure that domestic manufacturers remain competitive on the global stage by investing in cutting-edge processes and technology.

These recommendations underscore the necessity of balancing protectionist measures with strategies that facilitate innovation and maintain global competitiveness. For policymakers, the goal should be to craft an environment where domestic growth is supported, rather than stifled by the unintended consequences of poorly calibrated tariff measures.

Conclusion: The Road Ahead for U.S. Industrial Policy

As the United States stands at the crossroads of significant economic policy changes, the proposed semiconductor tariffs are emblematic of a broader shift towards strengthening domestic production capabilities. While the promise of an invigorated manufacturing sector and enhanced national security is appealing, the journey to achieve these goals is laden with tricky parts and complicated pieces. The trade policies of tomorrow must contend with both the fine points of domestic industrial policy and the subtle yet powerful dynamics of international trade.

For industry leaders, policy makers, and concerned citizens, the key takeaway is that the transition process will require both courage and careful planning. Businesses must be prepared to invest in domestic capabilities while mitigating the challenges associated with international trade dependencies. Equally, policymakers must strike a delicate balance between fostering a competitive domestic market and maintaining the benefits of global integration.

Ultimately, the success of the proposed tariffs will depend on cooperation across multiple sectors and levels of government. It will require transparent communication, phased implementation, and strategic interventions that help companies figure a path through the maze of new regulations. Only with these measures in place can the promise of a revitalized domestic semiconductor industry—and its many positive ripple effects for automotive manufacturing, industrial production, and overall economic stability—be fully realized.

As we look forward to tomorrow’s developments, we invite readers to stay engaged with the evolving policies and to participate in discussions that shape our nation’s economic future. The road ahead is fraught with challenges, but with informed debate and thoughtful action, there exists the potential for a more resilient and innovative domestic economy.

In the spirit of constructive dialogue, it is essential that all stakeholders—from business leaders to policymakers—continue to work closely together. Through collaboration and a shared commitment to national prosperity, the shifts in semiconductor tariffs may well pave the way for a transformed industrial landscape, one that is robust, adaptable, and ready to meet the demands of a fast-changing global environment.

As the chips of today become the core components of tomorrow’s innovations, the journey of transforming policy into practice will require patience, persistence, and a willingness to make tough decisions. In weighing the pros and cons, and in assessing the far-reaching implications for domestic industries, one thing is clear—the coming years will be critical in defining the shape and strength of the U.S. industrial future.

Originally Post From https://www.automotivedive.com/news/trump-semiconductor-tariffs-next-week/757799/

Read more about this topic at

Trump says he will set tariffs on steel and semiconductor …

Trump 2.0 tariff tracker