South African Automotive Industry: A Closer Look at Shifting Gears

The South African automotive sector is at a crossroads. For years, the industry has been celebrated as a manufacturing stronghold with international giants like Toyota, Mercedes-Benz, and Volkswagen calling the region home. However, in recent times, the scene has become increasingly tense and loaded with issues. With job cuts, company shutdowns, and a dramatic drop in localized production numbers, the industry now faces a number of tricky parts that demand attention from both government and business players.

In this opinion editorial, we take a closer look at the multifaceted challenges facing South Africa’s auto market—from the overwhelming pressures of US tariffs to the confusing bits of a stagnant localization rate—and discuss how the industry might steer through these obstacles in pursuit of a sustainable future.

Understanding the Impact of US Tariffs on South African Exports

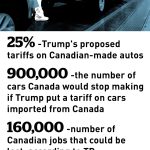

One of the key factors contributing to the current trouble in the South African automotive realm is the impact of US tariffs. Recently imposed at a rate of 30%, these tariffs have hit automotive exports hard. Trade Minister Parks Tau pointed out these tariffs at an auto parts conference, emphasizing that the impact is profound and full of problems for the industry.

To break it down:

- Export Value Loss: Tariffs have affected exports valued at R28.7bn ($1.64bn), which not only constitutes a significant loss in revenue but also directly threatens jobs in the sector.

- Contract Cancellations: Some companies have lost strategically important contracts in the American market, a move that has left stakeholders questioning the long-term sustainability of the current trade policies.

- Geographical Disadvantages: South Africa now faces the highest tariff rates in sub-Saharan Africa, exacerbating existing tensions on global trade.

The tricky funding, logistics, and administration associated with adapting to such overwhelming tariffs create not just economic hurdles, but also a nerve-racking atmosphere for local manufacturers trying to find a competitive edge in the international market.

Localization Rates and Imported Vehicle Pressures: The Tangled Issues of Global Trade

Despite the historical strength of local auto manufacturing, the realities on the ground tell a different story. In 2024, local production topped only 515,850 vehicles—far below the South Africa Automotive Masterplan 2035’s target of 784,509 vehicles. This shortfall is a stark reminder of the industry’s struggles amid a market dominated by imported vehicles. Currently, imported vehicles make up 64% of the market, leaving a very narrow margin for growth in local assembly.

This situation is also compounded by a low localization rate, where only around 39% of the vehicles incorporate locally sourced components, labor, and assembly—well below the desired 60% threshold. The following table summarizes some of the key data points:

| Indicator | Actual (2024) | Target (2035 Masterplan) |

|---|---|---|

| Locally Manufactured Vehicles | 515,850 | 784,509 |

| Imported Vehicle Share | 64% | — |

| Localization Rate | 39% | 60% |

This table indicates that the fine points of local production are not meeting the strategic targets, which in turn fuels the ongoing debate about how best to balance imports and domestic manufacturing. The tangled issues here are not just economic—they bring with them a series of complicated pieces such as employment stability, local supplier earnings, and the nation’s overall industrial growth.

Job Cuts and Industry Shutdowns: The Human Cost of Automotive Decline

The numbers tell a grim story. Over the past two years, no fewer than 12 automotive companies have been forced to shut down operations, leading to the loss of more than 4,000 jobs. In an industry that once provided meaningful employment to over 115,000 individuals (with another 80,000 involved in component manufacturing), these developments are not merely statistical—they have a real human cost.

The issue is riddled with tension at multiple levels:

- Direct Employment Impact: Thousands of workers have lost steady incomes, which creates a ripple effect in the economy.

- Supply Chain Disruptions: With fewer active manufacturers, local suppliers and component manufacturers face unstable demands and uncertain futures.

- Economic Confidence: High-profile shutdowns signal to investors and consumers alike that the market is on shaky ground, creating a sort of vicious cycle where downturns beget further contractions.

Given these challenges, industry analysts believe that it is essential to take a closer look at the human impact behind every production number and tariff statistic. The loss of jobs represents not just the cutting of payrolls, but the dismantling of communities and the disruption of long-standing business relationships that are critical for long-term growth.

Government Incentives and the EV Shift: Overcoming Nerve-Racking Obstacles

Recognizing that the current model is untenable, the South African government has started to expand its incentive schemes to boost local manufacturing—especially in the burgeoning electric vehicle (EV) sector. These moves come in the wake of the unsettling atmosphere created by both international pressures and domestic shortfalls.

The decision to direct additional support towards EV manufacturing is rooted in a few compelling reasons:

- Reducing Import Dependency: Shifting focus to EVs, where local assembly can play a stronger role, may gradually reduce the reliance on imported components.

- Environmental Benefits: Emphasizing cleaner, greener transport contributes toward national sustainability goals—a super important factor in future-proofing the industry.

- Technological Leap: By incentivizing EV production, South Africa is also tapping into a high-growth, tech-driven market that could potentially bring new skills and cutting-edge methodologies to local manufacturing.

Moreover, by adding EVs and related components to the incentive mix, the government is essentially trying to figure a path that might help boost not just production numbers, but also the localization rate and overall export quality. While such moves could be seen as an intimidating challenge given the nerve-racking investment costs, they are widely viewed as a necessary evolution to counter the many small distinctions that have troubled the industry.

International Brands and Local Production: A Global Strategy in the Making

Even amidst domestic challenges, international auto brands are looking to invest in the region. Notably, Stellantis and China’s Chery are in discussions about setting up production facilities in South Africa. Stellantis, for instance, recently announced its plans to roll out EV models under its Leapmotor brand, with the first being the C10 REEV, set to hit South African showrooms soon.

The global strategy behind these moves is multi-layered:

- Market Expansion: Brands see a unique opportunity to tap into a growing market that is ripe for a new breed of vehicles—one that might eventually help reverse the downward trends caused by imported vehicle dominance.

- Local Production Benefits: Establishing local production lines can help these multinational companies benefit from existing government incentives while also bolstering local job creation and skill development.

- Competitive Edge: The plan also involves leveraging technological exchange and best practices from established overseas operations to improve local manufacturing processes. Such international collaborations can help solve some of the hidden complexities that local manufacturers currently face.

This interest from global players shines a bright light on the potential that lies within a reformed South African automotive market. However, it also raises a number of tricky questions about how to best integrate international expertise with local manufacturing strengths. Stakeholders will need to work together to make sure that any new investments don’t simply boost imports but also contribute meaningfully to raising the domestic localization rate.

Policy Changes and Their Ripple Effects: Sorting Out the Government’s Role

Policymakers stand at the heart of this debate. Beyond imposing tariffs and setting localization targets, they are tasked with the delicate job of creating an environment where both local and international manufacturers can thrive without being overwhelmed by on-edge political or economic pressures.

The following points highlight some of the key policy considerations:

- Trade Negotiations: With South Africa offering a revised trade deal to Washington, there is a fine line to tread between protecting local jobs and ensuring that export markets remain open and competitive.

- Incentive Structures: Expanding incentive schemes to include EVs signifies a critical pivot towards modernizing the industry. However, such shifts must be managed carefully to ensure that they do not create a lopsided market focused solely on niche segments.

- Structural Reforms: To address the low localization rate, policymakers must find a way to encourage not only the assembly of vehicles but also the integration of local labor and component manufacturing, allowing South Africa to gradually reduce its dependence on imported parts.

Working through these policy changes is often a nerve-racking process, with every shift potentially triggering a number of unintended side effects. Yet, by taking a systematic approach and remaining responsive to real-time economic data, the government can start to steer through these challenging issues and create a platform for sustainable long-term growth.

Industry Recovery: Finding a Path Through Tangled Issues

Given the current landscape, industry experts suggest that another key area needing improvement is the overall perception of South Africa’s automotive market. The continuous downturn—characterized by the loss of production volume, significant job cuts, and a troubling dependency on imported vehicles—creates an intimidating image in the eyes of both local investors and global partners.

To chart a recovery roadmap, stakeholders must address several interlinked areas:

- Rebuilding Workforce Confidence: It is essential to create support systems for affected workers to ease the transition and re-skill them, making sure that job losses do not lead to broader social disruption.

- Fostering Innovation in Local Manufacturing: Investment in research and development, particularly in EV and green technologies, could help revitalize the sector with fresh talent and modern production techniques.

- Enhancing Supply Chain Resilience: Reducing reliance on imported components by developing robust local supplier networks would help mend some of the troublesome parts that have long hindered the industry.

The road to recovery is laden with both promising opportunities and nerve-racking obstacles. Stakeholders, from policymakers to corporate leaders, must take a close look at every small twist and every fine shade of the current economic problems. Only then can they work through these challenges in a way that brings stability back to the South African automotive market.

Spotlight on Electric Vehicles: A New Chapter for South African Mobility

The future of automotive manufacturing in South Africa appears to be shifting towards electric vehicles (EVs). As traditional combustion engine models face increasing environmental scrutiny and international trade tensions, EVs offer a promising alternative that aligns with both global sustainability trends and localized economic goals.

However, the switch to an EV-focused production model is not without its tricky parts. The industry must address various complicated pieces, such as:

- Infrastructure Upgrades: Charging stations, power grids, and other add-ons require significant upfront investment, which can be overwhelming for smaller firms.

- Technological Training: Workers need to be trained in new methods and processes to handle electric vehicle components, from battery pack integration to advanced electronics.

- Supply Chain Overhaul: Shifting from traditional components to those suitable for EVs demands a complete reconfiguration of existing supplier relationships.

Despite these challenges, early moves by major players like Stellantis demonstrate that the benefits of an EV pivot can outweigh the short-term nerve-racking challenges. As government incentives expand to include EV manufacturing, the industry is beginning to see this as a key opportunity to boost local production rates, create new jobs, and ultimately transform the public perception of the sector.

International Perspectives: How Global Trends Affect Local Realities

The global automotive industry is also evolving rapidly, and South Africa is not immune to these changes. Global trends toward sharing economy models, high-performance electric vehicles, and even autonomous driving technology are slowly making their mark on the local market. While these trends offer pathways to modernize and innovate, they also bring a host of intricate concerns related to international regulations, intellectual property rights, and competitive dynamics.

Some of the subtle parts that need careful consideration include:

- Integration of High-Tech Solutions: Companies must work to adopt emerging technologies while ensuring that legacy systems and traditional approaches do not hinder progress.

- Aligning with Global Standards: As local firms seek to scale up production and engage in cross-border trade, aligning with international quality and safety standards becomes super important.

- Partnership Opportunities: Collaborations with overseas manufacturers can bring in not just capital, but also valuable expertise that can help overcome local operational challenges.

Industry experts often encourage stakeholders to take a closer look at these trends and figure a path that leverages global strengths while bolstering local capacities. In doing so, South African manufacturers might not only maintain relevance but emerge as serious contenders in the global automotive arena.

Lessons from the Past and the Way Forward: Expert Opinions

A retrospective look at the trajectory of South Africa’s automotive industry reveals both cautionary tales and promising trends. Many experts emphasize that while the current situation is indeed full of problems, there are also significant opportunities hidden within these challenges. By digging into the finer details— the little details of job impacts, tariff repercussions, and market trends—industry insiders agree that a transformed approach is on the horizon.

Key opinions in the field suggest the following courses of action:

- Diversify Production: Expanding into EVs and related technologies can create new avenues for growth.

- Strengthen Local Supply Chains: Encouraging local sourcing and component manufacturing is critical to raising the localization rate.

- Enhance Policy Support: Continuous dialogue between government and industry leaders is required to develop incentives that truly address the current market’s tangled issues.

- Focus on Skills Development: Investing in workforce training and technology adoption will ease the transition into advanced manufacturing sectors.

Many of these viewpoints stress the need to figure a path that not only addresses immediate concerns but also lays the groundwork for a robust, innovative, and resilient automotive sector built to weather future twists and turns.

Reimagining Economic Recovery Through Collaborative Solutions

Beyond internal restructuring and policy revisions, there is another dimension to the recovery puzzle—collaborative partnerships. Bringing together domestic firms, international investors, and government bodies could well serve as a blueprint for future progress in the industry. The approach would involve shared responsibilities where each partner plays a role in solving the challenging parts of the current predicament.

Potential collaborative strategies might include:

- Public-Private Partnerships (PPPs): These collaborations can facilitate major infrastructure projects, such as building new EV charging stations or upgrading existing manufacturing facilities.

- Joint Ventures: Strategic alliances between local manufacturers and international companies can help transfer technology and expertise, tapping into the global best practices while remaining grounded in local realities.

- Research and Development Consortia: Pooling resources to invest in new technologies is essential. Such collective efforts can overcome the overwhelming parts of rapid technological change, enabling a smoother transition for local industries.

By embracing these collaborative solutions, the South African automotive sector can not only recover from its current setbacks but also set the stage for a future characterized by innovation, resilience, and sustainable growth. The key lies in understanding that the road ahead—while loaded with issues—is also filled with opportunities for those ready to make the leap.

Final Thoughts: Steering Through a Complicated Landscape

In conclusion, the South African automotive industry stands at a critical juncture. The combination of US tariffs, disappointing local production figures, and steep competition from imported vehicles paints a picture that is both tense and full of problems. Yet, there is a silver lining. With government initiatives, promising international investments, and a clear shift toward electric vehicles, there appears to be a path forward—even if that path is riddled with tricky parts and overwhelming challenges.

Industry stakeholders are now faced with the off-putting task of sorting out a multitude of interconnected issues. However, through collaborative efforts, persistent policy refinement, and a commitment to embracing modern technologies, it is possible to transform these challenges into stepping stones for long-term success.

As the automotive world continues to evolve on a global scale, South Africa must figure a path that not only revives its manufacturing might but also reasserts its position on the international stage. Whether it is managing tariff impacts, boosting local production, or riding the wave of the EV revolution, the country’s auto sector will need to work through every minute detail and chaotic twist in order to secure a prosperous future.

Stakeholders and policymakers alike must keep a close eye on each fine shade of this evolving narrative. Only by appreciating the little details, addressing the confusing bits of current shortcomings, and working relentlessly to overcome nerve-racking obstacles can the industry hope to turn its current full-of-problems state into a model of sustainable success.

Ultimately, revitalizing South Africa’s automotive industry is not merely about reaching predetermined targets or meeting localization thresholds. It is about reshaping an entire ecosystem to respond effectively to a rapidly changing global marketplace—one that increasingly values innovation, resilience, and environmental stewardship. Such a transformation requires daring leadership, relentless commitment, and the willingness to dive into every complicated piece of the puzzle.

As we watch this historic shift unfold, there is cautious optimism that the twists and turns ahead will lead not to further decline but to a rejuvenated and competitive sector that can once again be counted among the pillars of South Africa’s industrial base.

Originally Post From https://www.just-auto.com/news/south-african-auto-industry/

Read more about this topic at

Why Executives Think The US Auto Industry Is Headed …

Top 5 Challenges in the Automotive Industry in 2024