Understanding the Impact of Minor Tax Law Adjustments on Charitable Gifts

The recent changes in tax law and their effect on charitable giving have become a hot topic for business owners, nonprofit leaders, and ordinary donors alike. Small modifications to the way tax benefits are calculated might seem negligible at first glance, but these tweaks can, over time, erode the advantages that charitable donations have traditionally offered. In today’s environment, even slight adjustments can have wide-ranging implications for both donors and recipient organizations, especially as we look ahead to the updates that will take effect in 2026.

Many are still reeling from the unexpected twists and turns of recent legislative sessions, which have introduced both positive updates and notable new limits. As a result, those who rely on charitable contributions as a part of their financial planning need to be aware of these changes and how they might influence their overall giving strategy.

When you start to poke around the new rules, you quickly notice that the tax code’s subtle parts and tricky bits are making it more challenging for donors to maximize their benefits. In particular, even minor tax law adjustments can lead to significant shifts in the overall value of a charitable deduction, ultimately affecting the amount of support available to nonprofits and the initiatives they fund.

Why Early Action is Essential for Maximizing Charitable Contributions

One of the key messages from recent commentary is the importance of acting now rather than delaying decisions regarding charitable gifts. While some may view immediate action as an overwhelming or even nerve-racking move, experts emphasize that early planning is a must-have for anyone who wants to continue deriving economic benefits from giving.

There are several reasons for the urgency:

- Limited Time to Adjust: With new limits scheduled to take effect in 2026, donors who delay might miss out on maximizing deductions in the current or upcoming tax periods.

- Changing Tax Incentives: The tax system may offer less generous incentives in the future, meaning that gifts made under the old, more favorable rules are increasingly valuable.

- Uncertainty in Policy: Tax laws are prone to political influence and can be subject to rapid change, making it essential to secure as many benefits as possible before the rules shift further.

These factors form a complex puzzle that requires donors to sort out their charitable strategies and make informed decisions quickly. It is a classic case of balancing risk and reward—a scenario where a smart move today could translate into substantial long-term benefits, even if the immediate tax breaks might seem less obvious at first.

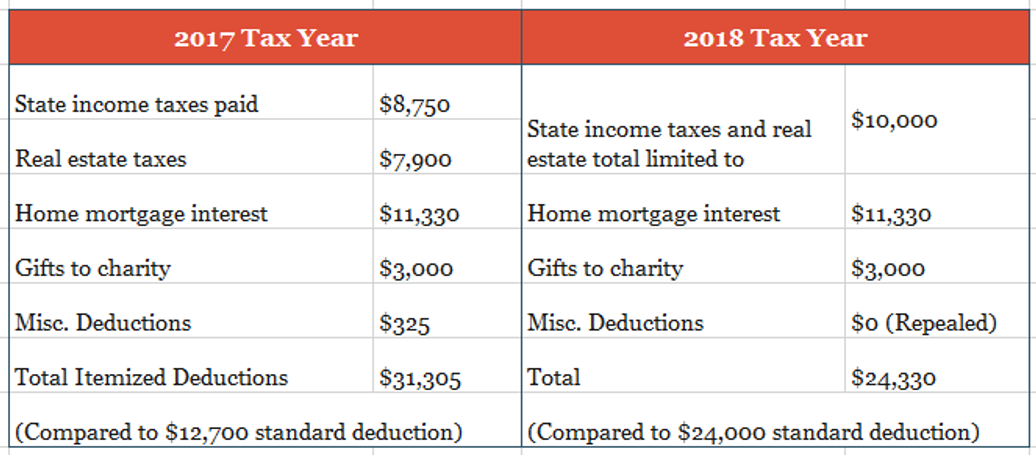

Comparing Old and New Tax Rules: A Closer Look

It is instructive to take a closer look at how the old rules compare with the new updates in several key areas. Understanding these small distinctions can help donors make their way through the tangled issues that the revised tax code presents.

| Aspect | Under Previous Tax Law | Under New Tax Law |

|---|---|---|

| Deduction Limits | Higher percentage limits on charitable deductions | Notable cuts in the percentage limits starting in 2026 |

| Eligible Contributions | Broader eligibility criteria for a wider range of donations | Tighter definitions, with increased scrutiny on certain types of gifts |

| Reporting Requirements | Less detailed reporting requirements | More intricate disclosure requirements, increasing compliance efforts |

| Tax Incentives | More generous tax incentives and credits | Reduced tax credits with a risk of eroding overall donation value |

This table is a quick reference meant to highlight the fine points that differentiate the old regime from the upcoming landscape. By sorting out these details, donors and advisors can better figure a path that both protects their financial interests and continues to support philanthropic initiatives.

Planning Ahead: Strategies for Effective Philanthropic Giving

For those invested in the long-term benefits of charitable giving, it is critical to work through the new requirements while keeping an eye on future legislative trends. Here are some insightful strategies that can help mitigate potential risks while continuing to harness the power of philanthropy:

- Review Your Giving Portfolio: Take a closer look at the mix of donations and platforms you use. Consolidate your giving channels in a way that maximizes current benefits before the new limits take effect.

- Diversify Your Contributions: Spread your generosity across multiple types of charities and causes. This allows you to smooth out risk as tax incentives for different donation types may vary under the new rules.

- Stay Informed on Legislative Changes: Legislation can be unpredictable. Continuously digging into legislative updates can help you be proactive rather than reactive.

- Set Up Contingency Plans: If there’s any hint of further adjustments or additional limits, having backup plans will empower you to get around any unforeseen problems.

Adopting these techniques can help you figure a path through a period that might otherwise seem full of problems. As with many financial strategies, the small distinctions matter a lot—what might seem like a tangled issue now could well turn into a critical point of optimization later on.

Consulting a CPA: Expert Guidance to Figure a Path Through Tax Amendments

The new tax regulations have introduced a range of confusing bits that can be challenging for even seasoned donors to decode on their own. This is where consulting a Certified Public Accountant (CPA) or a tax specialist becomes not just advisable, but essential.

Many individuals and small business owners are often intimidated by the additional compliance requirements and the slight yet significant shifts in tax benefits. A CPA can help by:

- Breaking Down the Changes: Professionals can dissect the subtle parts of the tax code, explaining how the new limits differ from the previous rules in clear, straightforward language.

- Creating Customized Strategies: Your financial situation is unique. Expert advisers can craft tailored approaches that ensure you continue to benefit from charitable giving while managing your liabilities.

- Monitoring Legislative Trends: Ongoing support from a CPA means you’re always up to speed on any new twists and turns that might impact your planned deductions or future donations.

- Ensuring Compliance: Tax regulations now come with additional disclosure and administrative requirements. Professional guidance can help avert unintended errors that might lead to audits or penalties.

Given the risk of inadvertent missteps, it is super important to work with someone who is well-versed in the nuances of tax law. This expert assistance can mean the difference between navigating safely through this period of change and running into costly mistakes.

Balancing Risk and Opportunity in the Future of Charitable Giving

The evolution of tax laws is a reminder that every adjustment presents both a risk and an opportunity. While new limits may seem intimidating at first glance, they also encourage donors to rethink their strategies and explore innovative approaches to maximize overall impact over time.

Here are several ways to balance these risks while pursuing strategic opportunities:

- Reevaluate Donation Timing: One practical step is to schedule significant donations before the implementation of tighter limits. This can help you secure advantages under the current rules rather than waiting for a less favorable environment.

- Consider Different Forms of Giving: Instead of relying solely on cash gifts, investigate alternative methods such as donor-advised funds, securities donations, or even planned gifts that could offer different tax implications.

- Mix Immediate and Future Gifts: Creating a diversified calendar of donations can spread risk and ensure a balance between immediate tax benefits and long-term philanthropic goals.

- Utilize Professional Planning Tools: Many legal and financial platforms now offer software and dashboards that help you measure the potential impact of multiple donation strategies against new tax limits.

Indeed, balancing risk and opportunity is not about avoiding the challenges that come with tax law reform—it’s about leveraging them as a means to make more informed decisions. Donors who are willing to invest time in understanding these subtle details will often find that there are real benefits to being proactive.

Exploring the Positive Updates Amid New Tax Limitations

While the narrative around the new tax laws often focuses on the potentially negative impacts on charitable giving, it would be unfair to ignore some of the positive updates that have come along with the changes. Every shift in policy has a mix of pros and cons, even when the effects seem skewed toward reducing benefits.

For instance, among the favorable aspects are:

- Enhanced Transparency: With more detailed reporting requirements, both donors and regulatory authorities now have a clearer picture of where contributions are going, an often underrated aspect of accountability.

- Encouraging Strategic Donation Behavior: These changes might prompt some donors to think more carefully about how to arrange their contributions, leading to smarter, more efficient philanthropic initiatives.

- Stimulating Innovation in Nonprofit Fundraising: Nonprofit organizations, forced to adapt to a changing financial landscape, may well develop new ways of engaging their supporters and broadening their funding streams.

By taking a closer look at the bright spots in this evolving framework, donors can lessen the feeling of despair that often accompanies regulatory upheavals. The key is to recognize that even in an environment that might seem on edge with challenges, there are aspects that can be advantageous if approached with a clear head and a proactive strategy.

Crafting a Long-Term Strategy for Sustainable Philanthropy

Looking into the future, it is essential for donors to assemble a long-term strategy that considers both the short-term disruptions and the broader trends affecting charitable giving. A sustainable approach requires continual adjustments and constant reconsideration of one’s financial and philanthropic priorities.

A comprehensive strategy should include:

- Goal Setting: Establish clear objectives for your charitable contributions, whether they are aimed at addressing immediate community needs or funding long-term initiatives.

- Periodic Reviews: Regularly assess your giving portfolio in light of current tax policies. This could mean holding an annual review with your financial adviser or CPA to measure effectiveness and compliance with all new rules.

- Openness to Adjustment: Be prepared to tweak your approach as legislative changes and economic trends emerge. Flexibility can turn potential pitfalls into opportunities for growth and innovation within your philanthropic pursuits.

- Communication with Nonprofits: Engage with the organizations receiving your support. By establishing a strong dialogue, you can better understand their challenges and collaboratively adjust your contributions for maximum impact.

An effective long-term strategy does more than just react to the changing rules—it anticipates them. It is an ongoing process of learning, planning, and fine-tuning that can help turn the complicated pieces of tax law into a framework for enhanced giving.

Adapting to the Future: The Cultural and Economic Shifts Impacting Philanthropy

Beyond the legal framework, broader cultural and economic trends are also influencing how people give. The rapid pace of technological change, global economic shifts, and evolving social expectations have all contributed to an environment where donors face both exciting opportunities and unpredictable challenges.

Many in the business community are now taking a more analytical approach to their charitable endeavors. They are integrating financial decision-making techniques that used to be the exclusive domain of corporate finance into their philanthropy strategies. This transformation, partly driven by increased data accessibility and advanced analytical tools, means that even the fine shades of tax adjustments are being examined under a microscope.

Advances in legal and financial technology—often referred to as legaltech—are easing some of the nerve-racking challenges associated with managing your path through frequent tax updates. For example, modern software platforms can help donors:

- Monitor tax law changes in near real-time

- Generate scenario analyses to see potential outcomes

- Assess the long-term impact of various donation types

- Ensure that reporting remains compliant with detailed disclosure requirements

These digital tools are making it easier for charitable givers to sort out the tangled issues that have long been a source of frustration and confusion. Armed with current data and expert recommendations, donors are better positioned to pivot quickly and securely, ensuring that their contributions yield maximum benefits for both themselves and the communities they support.

The Role of Policy Makers in Shaping the Future of Charitable Giving

No discussion about changing tax laws is complete without acknowledging the broader role of policymakers. Legislators are tasked with finding a delicate balance between raising necessary government revenue and encouraging private philanthropy.

New tax law measures often emerge as part of a larger agenda to reform outdated policies or rebalance public finances. While such reforms can feel off-putting to donors who value the status quo, there is usually a reasonable rationale behind the changes. In many cases, tighter contribution limits and stricter guidelines may be intended to close loopholes and promote a fairer distribution of tax benefits.

Policy adjustments are generally loaded with both intended and unintended consequences. For instance, while the new guidelines might discourage certain types of high-dollar gifts by diminishing their tax appeal, they could also drive innovation in how nonprofits seek and secure funding. Donors, nonprofits, and even tax professionals are all in the process of working through these new rules to figure a path that harmonizes with both economic realities and societal expectations.

Real-World Implications for Small Businesses and Individual Donors

For small business owners and individual donors, the new tax rules represent a double-edged sword. On one hand, these changes may seem to threaten traditional advantages. On the other hand, they prompt a reevaluation of how charitable contributions can be integrated into a broader financial strategy.

Small business owners need to consider the following points:

- Cash Flow Considerations: Adjustments to tax deductions can directly affect the bottom line, requiring you to get into a detailed analysis of when and how to best allocate funds for charitable purposes.

- Community Engagement: For many small businesses, philanthropic giving is part of a broader strategy to bolster community relationships. Renewing your commitment to charity—even in the face of new limits—may require redefining how you measure success beyond mere tax benefits.

- Long-Term Financial Planning: Whether you are an individual donor or a business owner, incorporating charitable gifts into a well-rounded financial plan can serve as a hedge against future tax fluctuations and shifts in economic policy.

Similarly, individual donors are encouraged to review their giving patterns. A deliberate reallocation of resources might involve splitting larger gifts into several smaller ones or shifting focus to trending causes that also align with evolving tax rules. In both cases, the aim is to make sure that charitable giving continues to provide personal tax efficiencies while also supporting causes that drive community benefit.

Addressing the Tricky Parts in Modern Philanthropic Planning

Many nonprofit leaders and financial advisers agree that while the new tax laws present several intimidating challenges, they also expose a number of opportune areas for growth. Modern philanthropic planning is filled with twists and turns that require both creativity and vigilance.

Some of the more confusing bits include:

- Interpreting Legislative Language: Even seasoned professionals find themselves diving in to really get into the nitty-gritty of the language used in the new measures. Words that once seemed straightforward can now carry multiple subtle meanings.

- Variable Impact on Different Donation Types: Not all contributions are affected equally. For example, donations of appreciated securities might be treated differently than cash gifts, meaning that donors have to figure a path through layered guidelines.

- Adaptive Strategies for Uncertain Times: The evolving nature of tax law requires a dynamic strategy—one that is capable of adjusting as further modifications emerge from ongoing political debates.

By taking the time to identify and understand these tangled issues, donors can better prepare themselves to steer through what might otherwise seem like a maze of frustrating rules. In many cases, these challenges become less intimidating when broken down into small, manageable steps.

Embracing a New Era of Philanthropy Through Innovation

The landscape of philanthropic giving is in a state of flux, driven not only by legal changes but also by technological innovation and shifting societal priorities. Nonprofits and donors alike are beginning to explore alternative avenues for making a meaningful impact, even as traditional tax incentives are recalibrated.

Innovative approaches that are gaining traction include:

- Digital Giving Platforms: In the era of digital transformation, online tools and crowdfunding platforms are enabling donors to contribute directly to specialized projects, often with a level of transparency that was previously unattainable.

- Collaborative Giving Models: Group philanthropy, including donor-advised funds and giving circles, help spread risk among several contributors while pooling resources for larger-scale initiatives.

- Impact Investing: Many donors are now looking at ways to invest in socially responsible ventures that not only yield a financial return but also address critical social issues, effectively combining profit with purpose.

These emerging methods represent a shift from traditional charity models and suggest that while tax rules may change, the underlying drive to support community projects and stimulate social progress remains unshaken. It is all about adapting to the times by mixing the tried-and-true with new, innovative strategies.

Taking the Wheel: Recommendations for Donors in a Changing Tax Climate

Given all the shifts and challenges discussed, the key takeaway for donors—be they individuals or small business owners—is to take control of your philanthropic strategy as soon as possible. Waiting too long might mean missing out on the benefits currently available, while early action could lock in advantages that may not be available once newer, stricter rules are enforced.

Here are some clear recommendations to help you get around the uncertain terrain:

- Assess Your Current Giving Framework: Review past donation patterns and estimate how much value you are currently deriving from tax breaks. Compare these figures with projected changes in the tax structure for 2026.

- Consult with Experts: Engage a CPA or a tax adviser who can help break down the new rules and offer personalized advice based on your circumstances. Their experience is key to managing your way through the fine shades and hidden complexities of the new regime.

- Monitor Legislative Updates: Stay subscribed to trusted legal and financial news sources. Regularly updating your knowledge ensures that you are not caught off guard by any further tweaks in tax policy.

- Plan in Layers: Develop a layered strategy that allows you to reap immediate benefits and slowly adjust your long-term giving structure. For instance, consider front-loading some of your donations before the new limits take effect, while scheduling periodic reviews to stay aligned with anticipated changes.

This multi-pronged approach combines proactive planning with expert advice and continual learning. In doing so, you are much more likely to secure the philanthropic benefits you desire, even in a regulatory environment that is full of unexpected hurdles.

A Perspective on the Broader Economic Environment and Its Influence on Charitable Donations

The changes in tax law regarding charitable contributions do not exist in a vacuum. They are part of a broader economic picture that includes shifting market dynamics, inflationary pressures, and varying political priorities. For both individual donors and small businesses, it becomes even more important to find your way in a multi-dimensional environment where each financial decision is linked to the larger economic scenario.

Consider the following aspects:

- Impact on Cash Reserves: Adjustments in deduction limits might alter how much cash you retain for other business ventures or personal investments. It is key to weigh immediate tax benefits against long-term liquidity needs.

- Economic Volatility and Uncertainty: During times when the economy feels tense or loaded with issues, making strategic charitable donations can serve as both a community support mechanism and a counterbalance to market uncertainties.

- Political Shifts: With changes in government and evolving political priorities, what looks like a minor legislative tweak today could be just the beginning of broader reform efforts that could affect a wide range of financial strategies, including philanthropy.

By keeping an eye on these trends, donors can better align their giving strategies with both personal financial planning and larger economic realities. In a sense, thoughtful charitable planning becomes part of a broader portfolio strategy—a diversified approach to wealth that acknowledges the benefits of giving while mitigating economic risk.

Conclusion: Proactive Steps Toward a Resilient Philanthropic Future

The adjustments in tax laws affecting charitable gifts serve as a stark reminder that even the smallest legal modifications can have far-reaching impacts over time. What might seem like a trivial change at first can, under sustained pressure, erode the benefits that have long been associated with philanthropy.

By acting now, engaging with trusted advisors, and deploying strategic planning measures, donors can make their way through the maze of new rules and ensure that their contributions continue to act as a catalyst for positive change. Through proactive planning, continuous learning, and the willingness to adapt, the challenges posed by evolving tax policies can transform into opportunities for improvement and innovation in charitable giving.

As we get into this brave new world—one that is full of small distinctions, tricky parts, and occasional overwhelming challenges—it remains super important to take a close look at both the risks and the benefits. Every donor should consider their unique financial circumstances, maintain an eye on the larger economic trends, and work side-by-side with professionals who know how to break down the tangled issues of new tax law.

In short, if you plan to make the most of your philanthropic efforts in the coming years, now is the time to figure a path through the evolving landscape. By confronting the complicated pieces head-on, you not only protect your personal tax benefits but also contribute to a more sustainable model of charity that supports communities across the board.

Ultimately, the future of charitable giving depends on smart, forward-thinking strategies that blend professional insight with a willingness to adjust to a changing economic and political environment. As donors, it is our responsibility to steer through these uncertain times with caution, optimism, and a well-devised plan to ensure that our contributions continue to make a meaningful difference.

In this era of economic shifts, while the new tax laws introduce what may seem like puzzling twists and turns, they also pave the way for innovative approaches to philanthropy. The key is to stay informed, remain flexible, and prioritize consultation with those who understand the subtle details of tax regulations. With careful planning and professional insight, you can turn what might seem like a nerve-racking challenge into an opportunity for lasting impact—both for your financial well-being and for the communities you support.

It is our hope that by taking these proactive steps today, we can collectively foster a philanthropic environment where charitable contributions remain a robust pillar of civic support and economic resilience, ensuring that generous acts continue to fuel positive change amid a landscape that is constantly evolving. Let us embrace these changes, work through the tangled issues, and confidently take the wheel of our financial and charitable futures.

Originally Post From https://www.law.com/2025/10/15/charitable-giftsnew-tax-law-philanthropy/

Read more about this topic at

Charitable Gifts—New Tax Law Philanthropy

How Will Non-Profits Be Impacted by the Big Beautiful Bill? …