Q2 Earnings Recap: What the Numbers Say About the Changing Auto Industry

The recent Q2 earnings season has provided a fascinating look into an industry that is both evolving and under pressure. As established giants and emerging players carve their path in a market riddled with tension, traditional automobile manufacturers and electric vehicle (EV) pioneers are facing a mix of promising growth and challenging twists and turns. In this editorial, we take a closer look at the Q2 performance of key industry players such as Ford, Tesla, General Motors, Winnebago, and Rivian. We will also consider the broader economic context, the impact of new EV-first competitors, and the implications for investors and market watchers alike.

Understanding the Auto Manufacturing Landscape This Quarter

Manufacturing functional, safe, and attractive automobiles for the mass market requires extensive capital investment and a mastery of tricky parts of engineering and design. With barriers to entry high and economies of scale acting as protective moats, established auto manufacturers can generally weather the storm. However, they are not immune to disruptive shifts, particularly with the rapid rise of electric vehicles. As incumbents wrestle with the decision of how much to invest in disruptive EV technologies while preserving their legacy products, the industry is experiencing a blend of steady performers and those facing formidable challenges.

The Performance Spectrum: Winners and Losers

This quarter, the group of six automobile manufacturing stocks managed to outperform analysts’ revenue estimates by a modest 1.5%. Although on the surface the overall performance appears resilient, a closer look reveals some subtle details and slight differences in how companies navigated the competitive landscape. Notably, Ford emerged as an unquestionable leader, while Tesla found itself dealing with slower revenue growth. Each company’s story offers valuable lessons on how to figure a path forward amidst evolving market conditions.

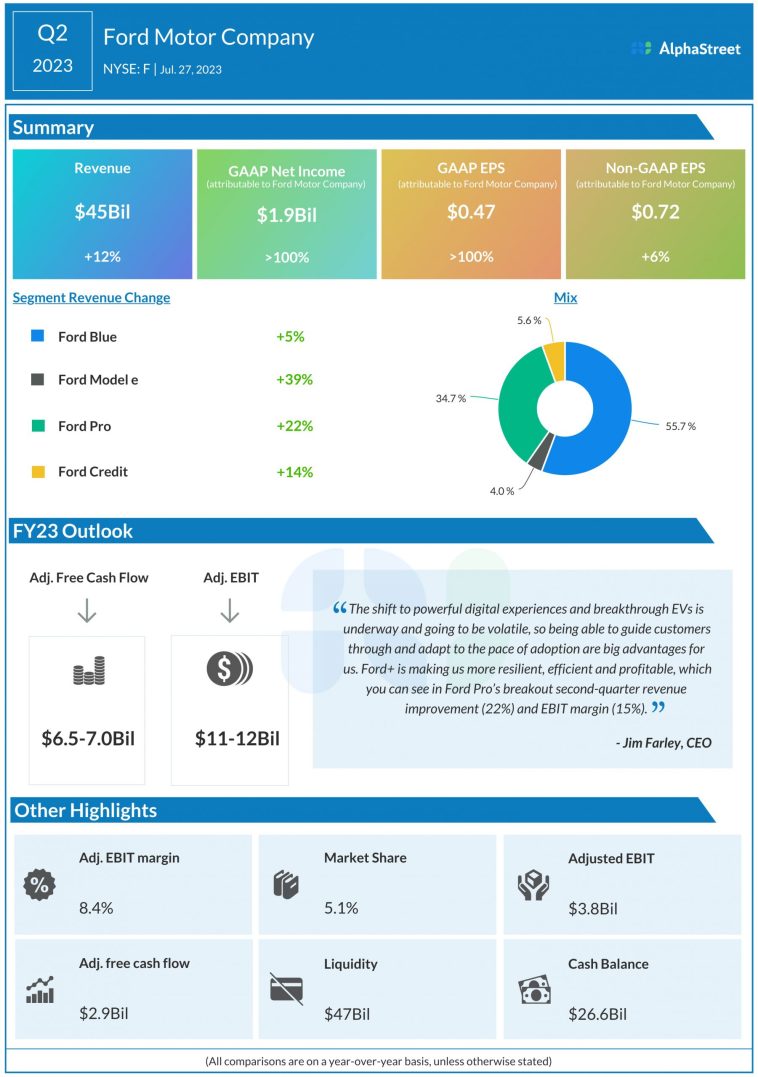

Ford: A Standout Performer in a Competitive Race

Ford’s strong performance this quarter is a reflection of its long-standing tradition of designing, manufacturing, and selling vehicles that appeal to a broad segment of the public. With revenues climbing to $50.18 billion—a 5% increase year on year—Ford has surpassed analysts’ expectations by 7.8%. This overachievement is not simply a number on a balance sheet but a signal that traditional automakers are successfully managing the tricky parts of transitioning to new technology while still capitalizing on their well-established brands.

Ford’s impressive result, marked by the biggest beat against analyst estimates among its peers, reinforces the idea that a long-term strategy combining robust capital investment and savvy operator experience is essential. The stock’s 6.1% increase since reporting has positioned Ford as an attractive proposition for investors looking to benefit from resilient fundamentals in a market full of confounding bits and crowded with new market entrants.

- Revenue: $50.18 billion (+5% YoY)

- Beat analysts by: 7.8%

- Stock increase since earnings: +6.1%

- Current trading price: $11.57

Ford’s success story serves as a reminder that while the industry undergoes significant transformation, companies that adapt and invest in both legacy and innovative solutions can continue to thrive.

Mixed Results: The Stories of Winnebago, General Motors, Rivian, and Tesla

Not all players managed to impress this quarter, and the picture becomes more complicated when we examine companies like Winnebago, General Motors, Rivian, and Tesla. Each of these stocks faced its own set of challenges and opportunities, with some reporting modest revenue increases or decreases, while others struggled with operational estimates.

Winnebago’s Steady Ride Amid Shifting Consumer Preferences

Winnebago, a name synonymous with high-quality and affordable recreational vehicles, reported revenues of $775.1 million—a slight dip of 1.4% year on year. Although this figure fell just short of analyst expectations by 0.8%, Winnebago’s performance offers some encouraging signs. Notably, the company managed to deliver a solid beat on adjusted operating income estimates. Even though full-year EPS guidance missed significantly, the market’s response was positive, as evidenced by the 12% increase in its stock since reporting.

This indicates that in a market full of nerve-racking estimations and sudden consumer trends, brands with dedicated customer bases and a reputation for quality can still maintain momentum. For investors, Winnebago might serve as an example of how a seasoned, niche market can be a stable ride in an otherwise turbulent industry.

- Revenue: $775.1 million (–1.4% YoY)

- Missed analyst revenue estimates by: 0.8%

- Stock increase since earnings: +12%

- Current trading price: $35.04

General Motors: Reliable, Yet Pressured by Changing Estimates

General Motors (GM), a storied name in automobile manufacturing with brands like Chevrolet, Buick, GMC, and Cadillac under its belt, reported revenues of $47.12 billion—a slight decrease of 1.8% year on year. While this revenue print managed to beat analysts’ expectations by 1.3%, there were tangled issues in other areas. GM missed analysts’ EBITDA estimates and sales volume projections, reflecting the nerve-racking nature of forecasting in a rapidly evolving industry.

Despite these pitfalls, GM’s stock has risen by 7.1% since reporting, which suggests that investors are willing to overlook the more complicated pieces in favor of the company’s long-term potential. In an industry where managing your way through market shifts is as important as the numbers on a quarterly report, GM’s performance offers insights into the balancing act required to stay competitive.

- Revenue: $47.12 billion (–1.8% YoY)

- Beat on revenue estimates by: 1.3%

- Missed EBITDA and sales volume estimates

- Stock increase since earnings: +7.1%

- Current trading price: $57.05

Rivian: The Ambitions and Challenges of a New Breed

Rivian, which recently gained attention as the manufacturer of Amazon’s delivery trucks, is one of the newer players in the electric vehicle market. The company reported revenues of $1.30 billion—a 12.5% increase year on year—surpassing analysts’ expectations by 2%. Nevertheless, Rivian’s quarter was marked by a softer performance when it came to full-year EBITDA guidance and adjusted operating income estimates, which both missed expectations significantly.

In a market where new entrants frequently face overwhelming challenges, Rivian’s story is a reminder of the fine balance between innovative potential and the nerve-wracking demands of scaling production and maintaining profitability. With the stock remaining relatively flat since the report, investors are watching closely to see if Rivian can figure a path through these early obstacles.

- Revenue: $1.30 billion (+12.5% YoY)

- Beat on revenue expectations by: 2%

- Missed EBITDA and adjusted operating income estimates

- Stock performance since earnings: Flat

- Current trading price: $12.17

Tesla: Facing the Strains of Rapid Transformation

Tesla, known as one of the most high-profile names in electric vehicles and founded by Martin Eberhard and Marc Tarpenning, found itself amid a challenging quarter. Reporting revenues of $22.5 billion, down by 11.8% year on year, Tesla came in 1.1% under analysts’ forecasts. This disappointing result was predominantly due to a miss in the Energy segment, which countered gains in Services and an in-line performance in Automotive. Additionally, Tesla’s operating income was a significant miss compared to analysts’ estimates. With the stock down 2.3% since the earnings announcement and currently trading at $325.25, Tesla’s performance represents the twists and turns inherent in rapid industry transitions.

The slow revenue growth and heavier-than-expected operational misses highlight the challenges that come with expanding into new technology sectors while retaining momentum in established markets. For Tesla, it is a period of rethinking and restructuring strategies in order to capture the potential of a sustainable energy future.

- Revenue: $22.5 billion (–11.8% YoY)

- Missed revenue expectations by: 1.1%

- Significant miss on operating income estimates

- Stock decrease since earnings: –2.3%

- Current trading price: $325.25

Deep Dive: Economic Trends and Their Impact on the Auto Industry

The current economic environment is an essential backdrop to understanding the auto manufacturing sector’s performance. A series of interest rate hikes by the Federal Reserve in 2022 and 2023, aimed at curbing inflation, have significantly cooled inflation rates from the post-pandemic highs. This effective disinflation was accomplished without a severe negative impact on economic growth, suggesting that a soft landing might be within reach.

Rate Cuts and the Stock Market Rally

Recent rate cuts—0.5% in September followed by another 0.25% in November—helped boost investor sentiment, contributing to a buoyant stock market in 2024. The market soared to historic heights following Donald Trump’s

presidential election win in November, a development that has continued to influence market dynamics. In a climate full of intimidating policy changes and unpredictable economic indicators, these moves provide some reassurance to investors who are seeking stability amid the twists and turns of economic cycles.

The table below summarizes key economic indicators and their impact:

| Economic Indicator | Description | Impact on the Auto Industry |

|---|---|---|

| Interest Rate Hikes (2022-2023) | Measures to reduce inflation | Increased borrowing costs; pressure on capital-intensive sectors |

| Recent Rate Cuts | Lowering lending rates to stimulate growth | Boosted consumer demand and market sentiment |

| Inflation Cooling | Return toward 2% target | Improved predictability and reduced cost pressures |

| Political Shifts | Election results impacting policy | Uncertain trade policies and corporate tax discussions |

This snapshot illustrates how economic actions and policies exert a ripple effect throughout the auto industry, affecting everything from manufacturing costs to consumer behavior.

Uncertainty Ahead: Trade Policies and Corporate Tax Discussions

Looking ahead into 2025, the outlook remains loaded with problems. Trade policy changes and ongoing debates surrounding corporate tax reforms are issues that could significantly impact business confidence and growth. Investors and industry players alike face a future where new policies, potentially confusing bits of tax legislation and shifting trade agreements, add an extra layer of challenge to an already competitive market.

This uneasy mix of optimism and caution means that companies will need to closely manage their way through policy adjustments while maintaining robust innovation and market engagement strategies. The landscape is set for further evolution, and the ability to adapt to these changes will be key to long-term success.

Technology Advancements and the Challenge of Adapting to Electric Vehicles

The auto industry has long been synonymous with mechanical innovation and manufacturing expertise. Today, however, the rise of electric vehicles is forcing every player to get into the intricate interplay of familiar mechanics and new battery technologies. The entrance of EV-first competitors has disrupted traditional business models and necessitated a reevaluation of capital allocation strategies.

The Disruptive Influence of EV Technology

Electric vehicles have not only shaken up consumer expectations but have also introduced a myriad of tricky parts when it comes to manufacturing and operational scaling. For traditional manufacturers, the challenge is twofold: clinging to a solid legacy in traditional vehicles while making a substantial pivot toward sustainable, electrified offerings.

Some key points include:

- Reallocation of capital from legacy production lines to new EV models

- Investments in battery production and state-of-the-art technology

- Adapting supply chains to handle components unique to EVs

- Managing production timelines amid rapid technological advances

These adjustments are not merely administrative tasks; they involve significant decision-making that can determine whether established companies maintain their positions as market leaders. In contrast, new entrants typically have the advantage of building their infrastructure from the ground up with an EV-first approach.

Balancing Legacy and Innovation

For traditional giants like Ford and General Motors, the task of balancing legacy manufacturing with the demands of EV production is both critical and challenging. This is a scenario laden with overwhelming challenges and tangled issues. Ford, for example, has managed to integrate EV offerings into its product lineup without sacrificing the brand’s classic appeal. Their performance this quarter signals that a well-calibrated balance between legacy and innovation can lead to profitable quarters.

On the flip side, Tesla’s recent performance shows how rapid changes and the integration of innovative technology still come with their own set of headwinds. Although Tesla has long been seen as the bellwether in electric mobility, their revenue drop and missed operating income estimates reveal that even the most pioneering companies can face setbacks when market expectations are high and competition intensifies.

Investor Perspectives: What Do Q2 Earnings Mean for Your Portfolio?

Investors have a challenging task when it comes to deciding which stocks to add to their watchlists. With the auto manufacturing sector showing mixed results this quarter, potential shareholders must sort out a number of factors before jumping into an investment. The earnings results provide both opportunities and warnings, and investors need to find their way through this maze of numbers, revenue forecasts, and operational guidance.

Key Considerations for Investors

When evaluating investments in the auto sector, here are some essential details to keep in mind:

- Revenue Trends: Look closely at both year-on-year revenue changes and how they compare to analyst expectations. Companies surpassing trends may offer more stability.

- Operational Guidance: Adjusted operating income estimates often reflect a company’s real-world challenges and successes. Significant beats or misses here can dramatically affect stock prices.

- Market Sentiment: The reaction of the stock market post-earnings, whether a positive spike or a decline, can indicate broader investor confidence and forecast expectations.

- Geopolitical and Economic Climates: With ongoing discussions about trade policies and corporate taxes, staying updated on economic developments is super important for investment planning.

Investors can use these criteria to figure a path towards identifying stocks that not only perform during stable times but can also withstand the overwhelming challenges when market conditions shift.

Using Data Tables for Clarity

Below is a consolidated table summarizing the Q2 performance of the major auto manufacturing stocks discussed in this editorial. This data provides a quick reference guide to the year-on-year revenue changes, analyst estimate beats or misses, and stock performance since the earnings reports:

| Company | Revenue Performance | Key Beat/Miss | Stock Movement Since Q2 | Current Trading Price |

|---|---|---|---|---|

| Ford | +5% YoY ($50.18B) | Beat analysts by 7.8% | +6.1% | $11.57 |

| Winnebago | –1.4% YoY ($775.1M) | Missed estimates by 0.8% | +12% | $35.04 |

| General Motors | –1.8% YoY ($47.12B) | Beat revenue estimates by 1.3% but missed EBITDA and sales forecasts | +7.1% | $57.05 |

| Rivian | +12.5% YoY ($1.30B) | Beat revenue estimates by 2% but missed EBITDA and adjusted operating income | Flat | $12.17 |

| Tesla | –11.8% YoY ($22.5B) | Missed revenue estimates by 1.1% and operating income estimates | –2.3% | $325.25 |

This table is intended to serve as a quick reference for both current market participants and those considering entry. The summer of earnings continues to offer lessons for anyone trying to manage their way through the complex bits of investment analysis.

Broader Market Themes and Implications for the Future

The Q2 earnings results also highlight broader themes that stretch beyond the auto industry. Recent months have seen shifts in consumer behavior, geopolitical tensions slowly easing, and an overall reevaluation of how capital is deployed in large industrial sectors. When trading through these economic cycles, companies are forced to grapple with both a rapidly evolving supply chain and the challenge of incorporating disruptive technologies into their long-standing business models.

Consumer Confidence and Shifting Priorities

In many ways, auto manufacturers are a barometer for consumer confidence and spending. The choices consumers make—from the type and style of vehicles to the willingness to embrace new technology—can have a domino effect on industrial manufacturing, marketing strategies, and even tax revenues. With a mix of established brands and revelations from new entrants, it is clear that consumers are increasingly looking for products that blend traditional reliability with modern innovation.

Some important consumer-related factors include:

- Affordability and Accessibility: Traditional values of quality and cost-effectiveness are critical for brands like Ford and Winnebago.

- Innovative Appeal: With the rising interest in sustainability, EVs have tapped into the desire for modern, environmentally friendly transportation solutions.

- Trust and Brand Legacy: Long-established companies continue to benefit from brand loyalty, even as they face stiff competition from disruptive newcomers.

The subtle details in consumer behavior, such as the slight shifts in purchase priorities among different demographics and the increased interest in sustainability, are super important when figuring out which strategies might succeed in the near future. Companies must adapt their messaging and product lines to this evolving landscape while maintaining the core values that have served them well over the years.

Policy Influences on the Business Environment

Another key element influencing the overall performance of the auto industry and industrial manufacturing sectors is the set of upcoming policy changes. As governments weigh new trade agreements, corporate tax policies, and environmental regulations, businesses must prepare for a period of finding their path through potential turbulence.

Key policy issues include:

- Potential shifts in trade policy that could affect supply chains and manufacturing costs

- Corporate tax discussions that might alter post-tax earnings and cash flow strategies

- Environmental regulations aimed at reducing emissions and encouraging the EV transition

These regulatory adjustments are a reminder for all industry players to stay vigilant, continuously adapt, and maintain transparency with investors. In an environment loaded with policy challenges, readiness to absorb new rules while keeping a laser-like focus on operational efficiency is a scenario that must be embraced to succeed long-term.

Looking Ahead: Strategies for Success in a Transforming Market

As we wrap up our deep dive into Q2 earnings and the state of the auto manufacturing industry, it is evident that these results are more than just quarterly numbers—they represent a snapshot of an industry in transition. Here are several strategies that companies and investors may consider as they prepare for the coming months and years:

Emphasize Agile Capital Allocation

Companies must learn to allocate capital in a way that balances the need to support legacy operations while investing heavily in future-oriented technologies. With EV alternatives influencing every part of the supply chain, firms that can efficiently divert resources towards innovative projects while ensuring that their core business remains strong are poised to reap significant rewards.

Steps toward agile capital allocation include:

- Regularly revisiting and revising innovation strategies

- Spotting the fine points in shifting consumer trends and technological advancements

- Prioritizing sustainable investments without sidelining profitable traditional lines

Focus on Enhancing Operational Efficiency

The Q2 results reveal that even well-established companies can struggle with meeting EBITDA and operating income targets amidst evolving market conditions. To steer through these challenging periods, enhanced operational efficiency will be key. Optimizing production processes, reengineering supply chains, and reducing overhead costs are measures that can provide a competitive edge in a market that is full of problems and unpredictable twists.

Key methods for improving operational efficiency:

- Streamline manufacturing operations through automation and advanced data analytics

- Reduce production costs by renegotiating supplier contracts and optimizing logistics

- Adopt lean manufacturing principles to cut unnecessary expenses

Maintain a Laser Focus on Consumer Needs

Understanding and reacting to consumer demand will always remain a central element of success in the auto industry. As consumer preferences evolve and new technologies become a norm, companies need to keep their ears to the ground. This involves continuous listening campaigns, monitoring social media trends, and engaging in market research to get into the subtle parts of what drives customer decisions.

Topics to focus on include:

- Accessibility and affordability of new vehicle offerings

- Environmentally friendly features that address sustainability

- Integration of smart technology and connectivity features

Conclusion: A Dynamic Road Ahead for Automobile Manufacturers

The Q2 earnings season has served as a compelling case study of an industry grappling with both tradition and transformation. Companies like Ford have shown that delivering on both legacy strengths and innovative potential can yield strong financial performance, while others like Tesla and Rivian underscore the nerve-wracking challenges that come with pioneering in uncharted territory.

In a market where oil-and-gear heritage meets electric ambition, automobile manufacturers are navigating the winding road of change. The influence of economic factors such as interest rate cuts, inflation moderation, and evolving trade policies adds additional layers to the decision-making process for both companies and investors alike.

As we look to the future, the message for market participants is clear: remain agile, keep a close eye on operational efficiency, and stay deeply connected to consumer needs. The lessons from this quarter apply not only to those directly involved in the manufacturing of automobiles but also to a wider audience of business analysts and investors aiming to understand the interplay of innovation, policy, and market dynamics.

For investors, the Q2 outcomes from Ford, Winnebago, GM, Rivian, and Tesla offer a mixed bag of cautionary tales and success stories. They underline the importance of diversified strategies in investment portfolios and the need to pay attention to both overt performance metrics and the subtle details that hint at future trends.

As the auto industry continues to evolve, companies that can figure a path through technical challenges, manage tangled issues, and get into the details of consumer demands will be the ones best positioned for long-term success. Whether you are a seasoned investor or a business leader striving to take the wheel in your organization, the current landscape promises both opportunities and challenges in equal measure.

Ultimately, the road ahead is dynamic and full of surprises. The interplay between legacy operations and new-age technology, combined with external economic shifts, will result in a continuously shifting market environment. Staying considered, patient, and proactive in addressing both immediate concerns and future opportunities will be key to thriving in this evolving sector.

For those interested in further exploring these themes, keeping an eye on the detailed analysis of each company’s performance and the broader economic context is a must. With growth stocks still presenting opportunities irrespective of political or macroeconomic climates, the journey of investing in the auto industry remains as exciting as it is unpredictable.

In summary, while assessing Q2 earnings might feel like steering through confusing bits and overwhelming data sets, it ultimately provides an essential guide for the future. With a clear focus on agile capital allocation, enhanced operational efficiency, and a steadfast commitment to meeting consumer needs, the industry has a robust blueprint for innovation. The road ahead, although filled with twists and turns, holds promise for those who are ready to embrace change and invest in meaningful progress.

Originally Post From https://stockstory.org/us/stocks/nyse/f/news/earnings/q2-earnings-recap-ford-nysef-tops-automobile-manufacturing-stocks

Read more about this topic at

Ford (NYSE:F) Tops Automobile Manufacturing Stocks

Can Group 1 Automotive Inc. stock outperform in a bear …