Automotive Trade Tensions: How Tariffs Are Reshaping the North American Landscape

The North American automotive industry is in the midst of a dramatic transformation. The recent data indicating that Canada imported more vehicles from Mexico than from the United States in June has raised eyebrows and fueled debate. Once a well-ordered region where American-made cars and parts flowed almost without interruption, the intricate balance has shifted. These changes come in the wake of President Trump’s implementation of hefty tariffs on foreign vehicles, a move that has sent shockwaves across the global auto market.

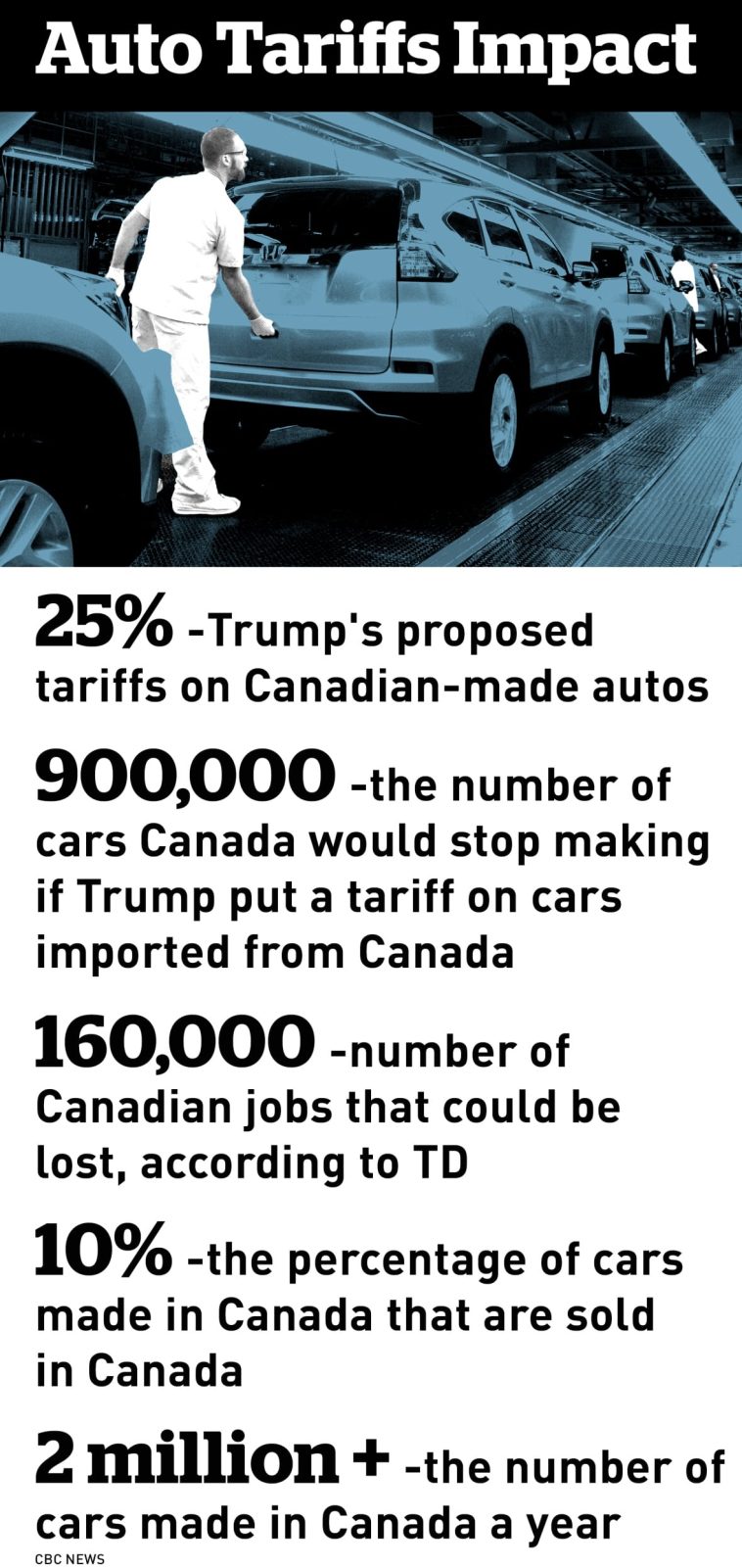

For decades, the United States was the primary source of finished vehicles imported by Canada. However, with the Trump administration’s imposition of a 25% tariff on foreign vehicles, the market dynamics have become tangled with twists and turns that businesses are only beginning to sort out. In this editorial, we take a closer look at the impacts, implications, and future possibilities of this historic shift, while poking around at the tricky parts of tariff policies and the reaction of stakeholders in this tense environment.

Tariffs and Trade: Setting the Stage for Disrupted Supply Chains

One of the more significant changes in recent months is how these tariffs have triggered a shift in the North American supply chain. Prior to these measures, a well-oiled system allowed vehicles and parts to cross borders between Canada, the United States, and Mexico with little friction. That free flow is now under pressure, forcing automakers to either adapt or face interruptions in their production and distribution cycles.

The tariffs have not only altered the playing field but also introduced a series of complicated pieces that are confusing bits even to seasoned industry insiders. These measures have created a challenge that is both overwhelming and nerve-racking. The fine points of applying tariffs—such as the duty only being levied on the value of non-U.S. content when products are shipped under the U.S.-Mexico-Canada Agreement—are just one example of the hidden complexities now at play.

While some relief has been offered in narrow ways, it does little to repair the strained trade relationship between the United States and Canada. The imposition of these tariffs has led to conflicting policies: even as the U.S. seeks to boost onshore manufacturing, Canada has retaliated with tariffs on U.S.-assembled vehicles. This tit-for-tat has left many companies scrambling to figure a path through the tangled issues of international trade regulations.

Mexico’s Surge: A New Leader in Canada’s Auto Import Market

Data from Statistics Canada reveals an unprecedented development: for the first time in three decades, Canadian importers purchased more passenger vehicles from Mexico than from the United States. In June alone, Mexico’s auto exports to Canada amounted to approximately C$1.08 billion ($784 million), overtaking the C$950 million figure from U.S.-made vehicles. This shift, while surprising, is perhaps a predictable outcome of President Trump’s tariff policies, which have disrupted long-established trade flows.

Here are some key points illustrating this shift:

- Historic Trade Patterns: For nearly 30 years, Canadian data consistently showed American vehicles dominating the market.

- Tariff Impact: The 25% tariff on non-U.S. vehicles effectively shifted buyer interest towards Mexican-made cars, as they now face relatively lower barriers.

- Market Sensitivity: Canadian importers, ever mindful of cost pressures, have shown a willingness to explore alternative sources when faced with higher tariffs.

This new role for Mexico as a major supplier might be temporary, as other short-term variables and industry strategies continue to evolve. For example, the unusual surge in Canadian auto imports from the United States during February and March—averaging around C$2.5 billion monthly compared to a previous average of just over C$1.8 billion—was driven by automakers’ rush to move products before additional tariffs could kick in. However, as the market steadies, the long-term impacts of this trade shift will become clearer.

Canada’s Tariff Strategy: Mirroring and Mitigating U.S. Actions

Canada’s reaction to the Trump tariffs has been to impose its own set of tariffs on vehicles assembled in the United States. The mechanism of these Canadian tariffs largely mirrors the approach taken across the border, creating a sort of trade mirror match that intensifies the overall strain. However, the Canadian government has also introduced measures to ease the burden on automakers who maintain local manufacturing and investment. The goal is to strike a balance—a protective tariff regime that still encourages production within Canada.

This layered approach aims to create several outcomes:

- Protect Domestic Industry: By providing tariff relief for local manufacturing, Canada hopes to retain jobs and investment, even if short-term imports might fluctuate.

- Reciprocate U.S. Measures: The mirrored structure of the tariff is part of a retaliatory strategy aimed at affecting U.S. exports to a key market.

- Signal Negotiation Leverage: The reciprocal nature of these tariffs is also a bargaining chip in broader trade negotiations, potentially leading to a reworked agreement that could address both nations’ concerns.

While such steps may help mitigate some of the immediate challenges, they add another layer of tangled issues to an already complicated situation. Automakers are left weighing whether to pass on the increased costs to consumers or absorb them as part of a broader strategic pivot. Companies are exploring various means to steer through these changes—ranging from localized production shifts to revised supply chain strategies that defer or minimize the impact of tariffs.

Impact on U.S. Manufacturing and Cross-Border Trade

The shift in Canada’s sourcing strategy is a potential harbinger of broader implications for U.S. automakers. Historically, Canada has been by far the largest foreign customer of American-made vehicles, creating a significant export surplus that even extended to the parts sector. For many U.S. companies, Canada represented a stable secondary market that supported local manufacturing and supply chains.

For instance, companies like General Motors and Ford have long relied on the Canadian market to move vehicles produced in the United States. Although Ford’s assembly operations in Ontario have experienced periods of inactivity, commitments have been made to restart production with models like the F-Series Super Duty pickups. Such decisions illustrate the intricate dance automakers must perform, juggling the benefits of a shared North American economy with the complications introduced by trade policies.

In this light, automakers are confronted with several challenging decisions:

- Reconfiguring Supply Chains: With tariff policies dictating the cost structures, companies must review and possibly reconfigure their supply chains to optimize value.

- Rebalancing Production Locations: The need to produce closer to end markets is growing as companies try to dodge tariff-induced cost spikes.

- Managing Consumer Pricing: There is ongoing debate about whether automakers should pass the extra costs on to consumers or absorb them in order to remain competitive.

While many companies have kept broad price increases at bay, their strategies otherwise reveal a clear intent to align manufacturing decisions with new trade realities. Some have even shifted parts of production back to the United States or invested directly in local production facilities to secure a more favorable tariff treatment.

Digging Into the Supply Chain: The Shifting Dynamics of North American Production

The auto supply chain in North America has always been a finely tuned machine, characterized by its nimble movements across borders. Over the decades, this network has managed to capitalize on the unique strengths of each country: American innovation and high production capacity, Mexican cost efficiencies, and Canadian regulatory stability. However, the introduction of hefty tariffs is now challenging this equilibrium, forcing businesses to reexamine every little twist in the chain.

Companies are now faced with several intertwined issues:

- Rebuilding the Network: With longer supply chains and heightened tariff obligations, the need to rebuild or revise networks has become increasingly apparent.

- Cost Calculations: Increased tariffs are influencing cost breakdowns, necessitating a deep dive into the fine details of operating margins and pricing strategies.

- Market Responsiveness: Automakers now have to be more nimble, recalculating timelines and production schedules to account for potential delays and cost uncertainties.

As a table below illustrates, the restructuring of the supply chain has created a dynamic interplay between cost, production efficiency, and market demand:

| Factor | Pre-Tariff Era | Post-Tariff Changes |

|---|---|---|

| Production Location | Balanced across U.S., Canada, Mexico | Reevaluation with preference for local investment |

| Tariff Rate | Minimal or none under trade agreements | 25% on non-U.S.-assembled vehicles; mirror tariffs from Canada |

| Supply Chain Complexity | Relatively streamlined | Loaded with issues, requiring reconfiguration |

| Consumer Pricing | Stable pricing | Uncertainty with potential cost pass-through |

This table underscores the dramatic shifts underway. Companies are now tasked with finding their way through a landscape that is riddled with tension and filled with tricky parts that demand innovative solutions. It’s clear that until a more stable trading agreement is reached, uncertainty will remain a persistent theme that business leaders and policymakers alike must confront.

Evaluating Economic Implications: The Broader Impact on North American Trade

Beyond the immediate impact on vehicle imports and manufacturing, these tariff-induced changes hold broader economic implications for all three countries in North America. The automotive sector is just one piece of a much larger economic puzzle that includes parts manufacturing, research and development, and consumer spending.

Some critical economic considerations include:

- Job Market Stability: Shifts in production locations can lead to job losses or gains, depending on whether companies relocate facilities or invest in local production.

- Investment Trends: Economic policies that either encourage or discourage foreign investment will play a key role in determining the long-term health of the U.S. auto industry.

- Consumer Impact: Tariffs often lead to increased vehicle prices, prompting consumers to reconsider their purchase decisions, potentially slowing down market momentum.

- Cross-Border Economic Health: With the U.S. enjoying an auto trade surplus with Canada in recent years, significant shifts in consumer behavior and manufacturing practices can have ripple effects across sectors such as parts manufacturing and regional supply chains.

Policymakers on all sides are now tasked with the challenge of balancing protectionism with competitiveness in a market that has always thrived on cooperation and shared resources. These economic moves, while strategic in intent, carry the risk of creating a divided market where the once seamless cross-border flow of goods becomes a series of overly complicated procedures and confusing bits of high-stakes negotiation.

Lessons from History: A Cautionary Tale for Future Trade Agreements

History provides several lessons about the potential pitfalls of using tariffs as a trade weapon. Over the decades, the three-nation automotive supply chain established a model that many other industries have attempted to replicate. However, the current environment is markedly different due to the intensity of political rhetoric and the aggressive nature of the tariffs imposed.

Industry experts have noted several key lessons to consider:

- Unintended Consequences: Tariffs intended to protect domestic industries can often lead to an unintended shift in market dynamics, as seen with Mexico’s rise in the Canadian market.

- Long-Term Instability: While tariffs may offer short-term relief or protection, the long-term instability they introduce can discourage the kinds of investments that are essential for maintaining a robust supply chain.

- Economic Interdependency: The North American trade network is built on years of interdependency. Disrupting this balance with sudden policy shifts can create a ripple effect that is both overwhelming and challenging to reverse.

These lessons should serve as a reminder that, while trying to protect national interests, policymakers must take a measured approach that does not fracture the broader regional cooperation that has made North America an economic powerhouse. Addressing the little details and subtle parts of trade agreements is not merely a bureaucratic exercise—it is essential to maintaining a healthy, competitive economic zone.

Looking Ahead: Future Prospects for a Reshaped Auto Industry

Despite the current tension, there are glimmers of opportunity amidst the uncertainty. Automakers, suppliers, and policymakers are all now forced to re-assess strategies and invest in new technologies and production practices. While the ongoing tariff situation has introduced nerve-racking challenges, it has also become a catalyst for innovation and diversification.

Looking to the future, several trends are emerging:

- Increased Localization: With tariffs making cross-border production less attractive, there is a growing trend toward localizing production. This could potentially benefit the U.S. market as well as bolster domestic employment and technical skill development.

- Supply Chain Redesign: Companies are rethinking the fine shades of their supply chains. In a bid to avoid complications from future tariffs, many are exploring alternative supplier networks in regions outside of traditional hubs.

- Technological Advancements: The shift in production and trade is accelerating the adoption of new technologies, such as automation and flexible manufacturing systems, which can help offset higher labor and logistics costs.

- Regulatory Reevaluation: Ongoing political dialogue suggests that the current tariff landscape may eventually be reworked. As policymakers from the U.S., Canada, and Mexico weigh their options, there is a hope for more balanced trade agreements in the near future.

Some industry leaders believe that these changes, although intimidating at first, may pave the way for a more resilient North American auto supply chain. While the current measures are a far cry from ideal, they have forced companies to get into creative problem-solving—a process that might yield long-term benefits from increased efficiency and regional collaboration.

Weighing the Trade-Offs: Consumer, Industry, and Policy Perspectives

The extensive shifts in the North American auto trade are not just headline news—they are having a real impact on consumers, manufacturers, and the overarching policy environment. The trade-off between protecting domestic jobs and maintaining affordability in the automotive market is a tightrope walk full of conflicting interests.

Consumer advocacy groups have expressed concerns that tariffs might lead to increased vehicle prices, with the cost burden eventually passed on to the buyer. Conversely, industry insiders argue that a rebalanced supply chain could eventually lead to better quality, safer vehicles manufactured closer to home. In effect, everyone is left figuring a path through a maze of tricky parts and tangled issues.

From a policy perspective, the real challenge is to draft legislation that is flexible enough to accommodate rapid changes while consistent enough to inspire private sector confidence. Some specific policy ideas include:

- Revisiting Tariff Structures: Revising the current tariff framework could help ensure that the duty is applied more fairly, encouraging investment in regions most affected by policy shocks.

- Incentivizing Local Production: Offering additional support for local manufacturing can help mitigate the adverse effects of tariffs while preserving jobs and expertise within key sectors.

- Enhancing Cross-Border Collaboration: Building a more cooperative framework among the U.S., Canada, and Mexico may help address the hidden complexities of current trade disagreements and lead to innovative solutions that benefit the entire region.

Furthermore, as automakers continue to explore all options—whether shifting production to Southern borders or reconfiguring integrated supply networks—policymakers need to work together to ensure that the auto trade remains a cornerstone of economic stability rather than a persistent source of stress and commercial friction.

The Road Ahead: Strategic Adaptation in a Tense Trade Environment

As we take a closer look at the unfolding events, it is clear that the North American auto industry faces a period of significant readjustment. Many of the decisions made now are likely to shape the industry for years to come. Among the core challenges are decisions on whether to pass increased production costs to consumers or to absorb them in pursuit of market share. Automakers are now working through several strategic options, such as:

- Localized Manufacturing Investment: Reinforcing domestic production through capital investment and technological upgrades.

- Flexible Supply Chain Management: Adopting agile methods to respond quickly to policy changes and economic shifts.

- Cross-Border Partnership Strategies: Forging new alliances with suppliers and logistics partners across Canada, the U.S., and Mexico to mitigate the risk from any single policy change.

These moves are evidence of an industry learning to adapt in an environment loaded with issues. Though the landscape is now full of potential disruptions, industry leaders are also finding innovative ways to get around obstacles. They are embracing flexible production models and digital monitoring tools to better manage supply chain risks and ensure that production schedules remain on track despite policy jostles.

The challenges are undeniably intimidating. Yet, as many in the industry point out, change is inevitable when public policy reshapes long-standing economic ties. The current scenario—a world where Canadian importers are increasingly sourcing from Mexico—is a reminder of how quickly business models can be upended and the necessity of staying ahead of emerging trends.

Conclusion: Embracing a New Era of North American Auto Economics

The transformation taking place in the North American automotive sector is both profound and far-reaching. From the loss of historical market share by U.S. exports to the temporary rise of Mexico as Canada’s primary vehicle supplier, every element of the scene points to a new trade reality laden with tricky parts and tangled issues. Automakers, regulators, and consumers alike are currently navigating a maze of tariff policies, shifting production strategies, and evolving economic priorities.

It is clear that adjusting to these changes will not be an overnight process. Instead, the industry is set to weather a period of adaptation marked by a blend of strategic pivots and policy reform. Amid the uncertain future and the nerve-racking challenges, companies are already brainstorming creative solutions to manage their way through these new twists and turns.

In many ways, this transformation is a classic example of how policy decisions—intended to shift economic conditions—can fundamentally rewrite market dynamics. The current state of affairs serves as both a cautionary tale and a stimulus for future innovation. It is an invitation for policymakers to take a closer look at the small distinctions within existing trade agreements and find better ways to support integrated regional growth.

Ultimately, while there are no easy fixes to the challenges introduced by these tariff policies, the situation provides a critical learning opportunity. It compels all stakeholders to dig into the hidden complexities of modern trade and work together to build a more resilient, local, and cooperative auto manufacturing ecosystem. Whether automakers choose to pass costs onto consumers or absorb them while innovating their production processes, one thing is clear: the reshaping of the global auto supply chain is here to stay.

As we move forward, industry leaders and policymakers must stay engaged, continuously monitor the evolving landscape, and make informed decisions based on the real-world impacts of their policies. The coming years will likely see further adjustments as the industry finds its way through this tense period. For now, the current developments in North American auto trade not only highlight the immediate reverberations of political decisions but also underscore the importance of collaborative, well-thought-out strategies in facing the tricky parts of global economics.

In sum, the rise of Mexico’s auto exports to Canada, the retaliatory tariffs between the U.S. and Canada, and the subsequent effects on manufacturing and consumer pricing together mark the beginning of a new era. An era characterized by its need for creative problem-solving, technological innovation, and a shared commitment to overcoming the tangled issues that define modern trade. Only by working together and addressing these challenges head on can the North American auto industry hope to secure a stable, prosperous future.

Originally Post From https://www.detroitnews.com/story/business/autos/2025/08/12/u-s-auto-exports-to-canada-plummet-on-tariff-tussle-with-trump/85627346007/

Read more about this topic at

Auto Industry Takes $12 Billion Hit From Trade War

How Are Trump’s Tariffs Impacting Cars, Costs, and …