Electric Car Market: Volatility and Opportunity in a Changing Landscape

The electric vehicle arena is undergoing dramatic shifts, and recent data from the Society of Motor Manufacturers and Traders (SMMT) has only underscored the market’s sensitivity to external influences. In a month marked by a -5.0% drop in registrations to 140,154 units, the current state of the new car market highlights both the challenging parts and huge opportunities that lie ahead for manufacturers, consumers, and policymakers alike.

Recent developments, from cutting-edge utility offerings like the all-electric Mercedes Benz CLA Shooting Brake with a range of 761 km to concept models previewing luxurious and sustainable grand tours from Bentley, illustrate how innovation is reshaping the sector. Meanwhile, new announcements at prestigious events such as the Goodwood Festival of Speed—where MG showcased the MG IM5 sedan and MG IM6 SUV—and Rivian’s unveiling of the 2026 R1T and R1S Quad-Motor, are adding even more excitement to an already dynamic market. These innovations are setting the stage for a transformative period, even as traditional registrations continue to be affected by economic and regulatory factors.

In this editorial, we take a closer look at the performance metrics, policy debates, and groundbreaking vehicle introductions that are collectively framing the current trajectory of the electric vehicle space in the UK and beyond. We will also explore the super important details behind government incentives, fiscal challenges, and broader market trends, while considering what these mean for the future of transportation.

Understanding the Shifts in the UK New Car Market

Analysts have noted that the registration dip in July represents the market’s vulnerability to external factors. The numbers reveal a -3.2% drop in demand from private buyers and a -6.5% decline from fleet purchases, while the much smaller business sector experienced a notable 10.4% jump to 2,914 units. These mixed trends indicate that while the overall market is feeling the economic pinch, certain segments are bucking the trend by offering pockets of growth—particularly in the niche areas of Dual Purpose, Mini, and Luxury Saloon vehicles.

Looking at the month in detail, the majority of segments recorded declines, reflecting the way volatile economic conditions and regulatory adjustments impact consumer behavior. The performance of July—the second weakest month for battery electric vehicle (BEV) growth after April’s unexpected tax changes—shows that buyers are becoming more cautious. As a result, demand appears to be in a state of flux, with many customers waiting for clearer guidance regarding eligibility for recently announced fiscal incentives, such as the Electric Car Grant (ECG), designed to discount BEVs by up to £3,750.

In an economic climate loaded with tricky parts and confusing bits, market players are calling for increased certainty. The challenge lies in assuring buyers that the current uncertainties will be replaced by more stable conditions, encouraging immediate purchases rather than a wait-and-see approach. This state of hesitation does not just impact current registrations—it has a domino effect across multiple segments of the automotive value chain, from production and manufacturing to after-sales and support services.

Government Policy and Consumer Confidence: Finding Your Way Through Fiscal Incentives

One of the most pressing issues currently facing the industry is the effectiveness of fiscal incentives and government policy. The recently announced Electric Car Grant offers a key discount to potential buyers, but the lack of clear model eligibility has left many consumers in a state of limbo. With a potential discount of up to £3,750 hanging in the balance, this missing clarity is prompting many to delay decisions—a worrying sign for an industry that thrives on prompt consumer action.

Industry experts agree that if the government could work through the tangled issues surrounding purchase and charging incentives, BEV demand might see a significant boost. Current fiscal measures, such as the newly applied VED Expensive Car Supplement (ECS), are estimated to impose an effective fine of more than £360 million on BEVs purchased from April this year. These additional costs have the potential to dampen enthusiasm among buyers, especially when compared to the robust growth seen in plug-in hybrid electric vehicle (PHEV) registrations, which rose by 33.0%.

Key bullet points that encapsulate the current situation include:

- Demand in the private and fleet sectors falling by 3.2% and 6.5% respectively

- Business sector registrations on the rise by 10.4%

- PHEV registrations growing at 33.0% versus BEVs at 9.1%

- BEV market share increasing to 21.3%, yet still below the 28% target set by the ZEV Mandate

- The looming question around model eligibility for the Electric Car Grant

These bullet points underscore how navigating the current market requires clarity from policymakers and more intuitive communication of incentive details. For car buyers to make informed decisions, it is super important that policymakers address these confusing bits head-on with clear timelines and eligibility criteria.

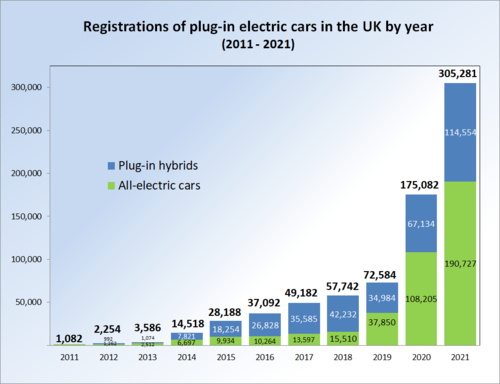

Growth in Plug-in Hybrids and Battery Electric Vehicles

Despite the overall market dip, plug-in hybrid electric vehicles (PHEVs) have experienced a remarkable surge in registrations, growing by 33.0%. Battery electric vehicles (BEVs), while also showing progress with a 9.1% increase, still had a modest performance when compared to the first half of 2025’s surge of 34.6%. These mixed messages indicate that while buyers are warming up to electrified mobility solutions, the shift is not uniform across vehicle types.

This dual behavior in the market is a reflection of subtle differences in consumer priorities. For many buyers, the extra range afforded by hybrid systems and the assurance of existing refueling infrastructure make PHEVs an attractive choice in a climate full of problems and economic uncertainties. Conversely, true BEV enthusiasts, who are often more focused on environmental causes, are bogged down by fiscal disincentives and areas of unpredictability regarding grant availability.

The table below encapsulates the recent registration figures and corresponding percentage changes in key market segments:

| Vehicle Segment | Percentage Change |

|---|---|

| Private Buyers | -3.2% |

| Fleet Purchases | -6.5% |

| Business Sector | +10.4% |

| PHEVs | +33.0% |

| BEVs | +9.1% |

This data suggests that while innovative vehicle types continue to gain traction, more subtle details such as buyer confidence and clarity in fiscal policy are just as super important for sustained growth. Industry leaders have noted that a more stable and transparent fiscal environment will be key to converting these statistical upticks into long-term market trends.

Challenges and Opportunities for the Automotive Manufacturing Sector

At its core, the automotive manufacturing sector is facing a challenge of finding its path through a maze of economic uncertainty, policy changes, and evolving consumer expectations. Even though the market remains up 2.4% year-to-date, the monthly fluctuations demonstrate that no segment of the industry is immune to the twists and turns of a volatile global market. The overall market volume reached 1.18 million units, including over a quarter of a million BEVs, thanks to a range of attractive new models and substantial manufacturer discounting.

For manufacturers, the key lies in addressing the fine points that govern consumer decision-making while simultaneously steering through policy-induced hurdles. Industry leaders have repeatedly stressed the necessity for clearer government incentives, which they consider to be essential for maintaining production momentum and supporting the country’s automotive manufacturing base—a cornerstone of the broader Industrial Strategy.

The manufacturing community is tasked with managing your way through both supply chain issues and mounting fiscal pressures. As manufacturers continue to invest in new technologies and production capabilities, they also need to consider:

- Enhancing supply chain resilience amid volatile global conditions

- Optimizing production to meet the rising demand for PHEVs and BEVs

- Leveraging manufacturer discounting strategies to drive consumer interest

- Collaborating closely with government bodies to streamline fiscal incentives

Each of these points represents critical factors that manufacturers must address in order to remain competitive. The manufacturing sector, therefore, stands at a crossroads—where strategic agility and clear communication with policy influencers will dictate the future path.

Innovations in Electric Vehicles: A Look at New Models and Concepts

Electric vehicle innovation is not just about incremental changes; it’s about radical rethinking of design, performance, and sustainability. Consider, for example, the trailblazing all-electric Mercedes Benz CLA Shooting Brake, boasting an impressive 761 km range—a reminder of how far battery technology has come. As consumers are increasingly drawn to vehicles that combine style with long-range capabilities, this model signifies a leap forward in blending luxury with sustainable mobility.

Adding to the buzz is MG’s recent announcement at the Goodwood Festival of Speed, which saw the unveiling of the MG IM5 sedan and MG IM6 SUV. These models showcase not only the practical benefits of electrification but also hint at a future where everyday driving becomes both eco-friendly and highly appealing. Similarly, news of Rivian’s 2026 R1T and R1S Quad-motor offerings, along with Bentley’s EX 15 concept, highlights the diversity of approaches that automakers are using to meet evolving consumer tastes. From rugged performance trucks to ultra-luxurious tourers, the electric vehicle lineup is expanding into every conceivable niche.

Each model not only represents a technical achievement but also speaks to broader consumer trends and economic considerations. With manufacturers launching vehicles that cater to specific segments—be it performance, luxury, or practicality—the onus is now on the industry to ensure a smooth transition for buyers focused on sustainable mobility. And while model announcements generate excitement among enthusiasts, they also need to be placed within the broader context of market stability and economic assurance.

Here’s a brief snapshot of some of the latest innovations in the electric vehicle space:

- Mercedes Benz CLA Shooting Brake: A fusion of luxury and efficiency with a range topping 761 km.

- MG IM5 Sedan and IM6 SUV: Unveiled as part of a new push towards versatile electric mobility.

- Rivian’s 2026 R1T and R1S: Quad-motor innovations that are shaping the future of performance electric vehicles.

- Bentley EX 15 Concept: A preview of how high-end grand tours could merge luxury with sustainability.

Each announcement contributes to a broader narrative of transformation—a narrative that underscores both the technological potential and economic challenges present in today’s shifting automotive landscape.

Strategies for Maximizing Fiscal Incentives and Business Tax Benefits

Given the sensitive balance between consumer confidence and economic incentives, one super important area that deserves attention is the realm of fiscal incentives and business tax benefits. The Electric Car Grant, along with manufacturer discounts, is designed to provide an alternative path through the overwhelming fiscal challenges associated with adopting a BEV. However, the lack of utter clarity about which models qualify for these incentives continues to be a sticking point.

The imposition of the VED Expensive Car Supplement, estimated to penalize BEV purchases by more than £360 million, combines with the uncertainty surrounding grant eligibility to create an environment loaded with issues for potential buyers. Many industry leaders argue that resolving these problematic bits should be a top priority for policymakers. Restoring consumer confidence is pivotal not only for increasing BEV volumes but also for stimulating broader economic growth across the automotive sector.

To summarize the strategic steps needed for maximizing fiscal incentives, consider the following bullet list:

- Clarification of eligibility criteria for the Electric Car Grant

- Reduction or removal of punitive fiscal measures like the VED Expensive Car Supplement

- Enhanced collaboration between industry stakeholders and government bodies

- Targeted manufacturer discounts that make the transition to electric easier for consumers

- Clear communication to ensure buyers understand the fine details of each incentive

Addressing the above points not only helps steer through current economic challenges but also sets a precedent for a more stable and predictable market in the years ahead. Industry bosses have reiterated that providing super important fiscal certainty is paramount for increasing demand and supporting the UK’s automotive manufacturing base—an objective that fits squarely within the framework of the government’s new Industrial Strategy.

Economic Implications of EV Adoption and Broader Market Impacts

The interplay between electric vehicle adoption and broader economic factors is a conversation full of slight differences and messy twists. For instance, while BEV market share has grown from 18.5% to 21.3% year-over-year, this upward change is still lagging behind the 28% threshold required by the Zero Emission Vehicle (ZEV) Mandate. This gap is not just a statistic—it reflects the pressing need for stronger, more coherent initiatives to drive further adoption.

Manufacturers, purchasers, and policymakers are all working through a maze of economic uncertainties, ranging from fluctuating registration figures to tax policies that seem at times on edge. The ripple effect of these issues spreads from the showroom floor to the broader economy, bearing implications for everything from job creation in the manufacturing sector to the overall stability of the automotive supply chain.

Economists point to several interconnected factors that shape this ecosystem. For example, limited government incentives and a lack of clear fiscal guidance are leading to consumer hesitation, which in turn can slow down the momentum of the entire market. Buyer hesitation presents a classic case of supply and demand not quite in sync, where manufacturers ready innovative models but find that buyers are waiting for stronger economic signals before they commit.

Some of the key economic implications include:

- The need for a stable fiscal environment to encourage consumer confidence

- Potential risks to the automotive manufacturing base if consumer demand continues to wane

- Effects on supply chain stability and associated economic ripple effects

- Long-term economic benefits from increased adoption of sustainable mobility solutions

The market outlook, revised up to 1.9 million units for 2025, suggests that while short-term dips might create nerve-racking moments, the overall trajectory remains positive. With BEVs expected to capture a 23.8% share by year’s end, industry insiders remain cautiously optimistic that the current hurdles will be overcome in due course.

Consumer Behavior in an Era of Changing Automotive Trends

Beyond policies and production numbers, another key piece of the puzzle lies in the hearts and minds of auto buyers. When new options—from groundbreaking luxury electric vehicles to everyday practical BEVs—enter the market, they naturally pique consumer interest. However, even with exciting new models available, the intimidating prospect of navigating a market full of confusing fiscal bits can lead to hesitation.

Many consumers today are characterized by their desire for transparency and certainty. They want to be reassured that each purchase decision will provide them with lasting value. For some, the anticipated benefits of the Electric Car Grant and other manufacturer discounts represent vital incentives that justify switching to a BEV. For others, the risk associated with tax amendments and unexpected fiscal policies is enough to compel them to delay their purchase until all the tangled issues are resolved.

This divergence in buyer behavior is evident when looking at the surge in PHEV registrations versus a more muted BEV uptake. The table below outlines some of the influencing factors:

| Influencing Factor | Impact on Consumer Decision |

|---|---|

| Clear Fiscal Incentives | Boosts buyer confidence, leading to more immediate purchases |

| Ambiguous Eligibility Criteria | Causes hesitation and delays in final decisions for BEVs |

| Innovative New Models | Generate excitement, particularly among tech-savvy and eco-conscious buyers |

| Market Volatility | Exacerbates buyer caution, with many adopting a “wait-and-see” approach |

The above data brings to light a crucial point: consumer behavior in the current automotive market is deeply intertwined with economic signals and government policies. For the industry to continue growing, it is imperative that these external factors are managed carefully, ensuring that buyers feel secure enough to commit even in the face of short-term market fluctuations.

The Road Ahead: Balancing Innovation, Policy, and Market Dynamics

The road ahead for the electric vehicle sector is one of cautious optimism. While challenges remain—from policy uncertainty and economic volatility to the nerve-racking task of clarifying eligibility for incentives—the increasing diversity of models and the surges in certain market segments suggest a bright future. With automakers like Mercedes Benz, MG, Rivian, and Bentley pushing the envelope of what’s possible, the industry must work together to strengthen consumer trust and streamline fiscal policies.

Looking forward, the following strategies emerge as key for ensuring continued growth and stability:

- Clear Communication: Both government bodies and manufacturers need to provide clear, unambiguous guidelines on the various incentives available. Ensuring buyers can easily figure a path through the fine points of fiscal measures is critical.

- Enhanced Incentive Structures: Revising policies such as the VED Expensive Car Supplement could help remove some of the intimidating fiscal barriers currently affecting BEV demand.

- Continued Innovation: As new models and updates continue to hit the market, ongoing technological improvements will play a key role in attracting a broader base of consumers.

- Collaborative Industry Efforts: Stronger partnerships between manufacturers and policymakers can help address both the straightforward and tangled issues that are stalling market momentum.

Analysts predict that if these strategies are implemented effectively, the electrification of the automotive industry will not just be an isolated trend but will set the foundation for broader economic and environmental benefits. Restoring consumer confidence and ensuring robust fiscal support may well accelerate the shift towards electric mobility, delivering benefits that extend well beyond individual vehicle registrations.

Conclusion: A Transformative Moment in Automotive History

We are witnessing a truly transformative moment in automotive history. The recent market dip—while a cause for concern in the short term—also represents a critical period of realignment and recalibration. Manufacturers are innovating at an unprecedented pace, and new models such as the Mercedes Benz CLA Shooting Brake, MG’s latest offerings, Rivian’s quad-motor marvels, and Bentley’s luxurious yet sustainable EX 15 concept indicate the depth and breadth of industry commitment to a cleaner future.

At the same time, the market dynamics—characterized by shifts in consumer behavior, fiscal incentives that are either working or in need of urgent streamlining, and subtle differences between PHEV and BEV performance—make it clear that the journey is far from over. The current phase of transition, though riddled with economic twists and turns, offers a valuable opportunity for all stakeholders involved. With industry insiders calling for greater clarity on fiscal incentives and more decisive action from policymakers, now is the time to step up and trust that the improvements in both technology and regulation will pave the way to a more predictable, stable market.

Moving forward, the industry must balance these evolving dynamics carefully. It is not merely about increasing registrations or hitting production targets—it’s about securing a sustainable future that benefits manufacturers, consumers, and the environment alike. Whether you are a prospective buyer hesitating in the showroom or an industry leader steeped in making policy work better, these are exciting yet challenging times. And as the electric vehicle revolution continues to gain momentum, the next few years will be crucial in determining how effectively we can steer through these complex and sometimes nerve-racking fiscal landscapes.

In summary, the electric vehicle market is entrenched in a period of both setbacks and breakthroughs. With innovative models capturing public imagination and fiscal policies set to evolve further, the industry faces a pivotal moment. With coordinated efforts that address the confusing bits of fiscal policy and the subtle differences in consumer behavior, the industry can truly accelerate the shift towards a sustainable future—a future where electric vehicles not only dominate the roads but also catalyze broader economic growth and environmental progress.

While challenges remain, the growing enthusiasm for electrified mobility—combined with strategic support from both the private and public sectors—offers hope. As we dig into this evolving landscape, it becomes clear that the path to widespread electric vehicle adoption is loaded with both opportunities and risks. Success will depend on our ability to figure a path that not only meets the current demands of consumers but also supports long-term innovation and fiscal sanity.

For industry pioneers, policymakers, and consumers alike, these are exciting times. With the right actions and strategies in place, we can look forward to a future where the electrification of transport not only revitalizes the automotive manufacturing sector but also propels us toward a cleaner, more sustainable environment. The coming years will tell the full story of this revolution—a story full of promising innovations, challenging fiscal realities, and, ultimately, a transformative shift in how we think about transportation.

Originally Post From https://electriccarsreport.com/2025/08/uk-battery-electric-car-registrations-rise-over-9-in-july/

Read more about this topic at

Global EV Outlook 2025 – Analysis

Electric Vehicle Outlook